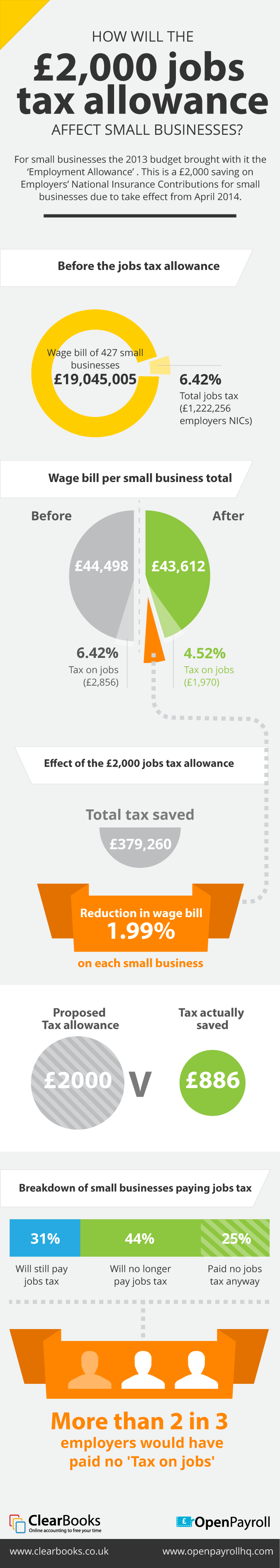

For small businesses the 2013 budget brought with it the ‘Employment Allowance’ . This is a £2,000 saving on Employers’ National Insurance Contributions for small businesses due to take effect from April 2014.

Clear Books and Open Payroll, providers of online accounting and payroll software, jointly analysed 427 small businesses to examine how this new ‘jobs tax’ allowance would have affected small businesses if it had been applied in the current tax year.

2 in 3 employers would have paid no jobs tax. The average small business wage bill would have been cut by 2%.

To learn more about how the £2,000 employment allowance affects small businesses, see our latest infographic.