From April 2019, HMRC will kick off their plan to digitise the UK's tax system. Known as Making Tax Digital (MTD) it will be compulsory for VAT-registered businesses with a taxable turnover of more than £90,000 to submit their VAT returns digitally to HMRC every quarter.

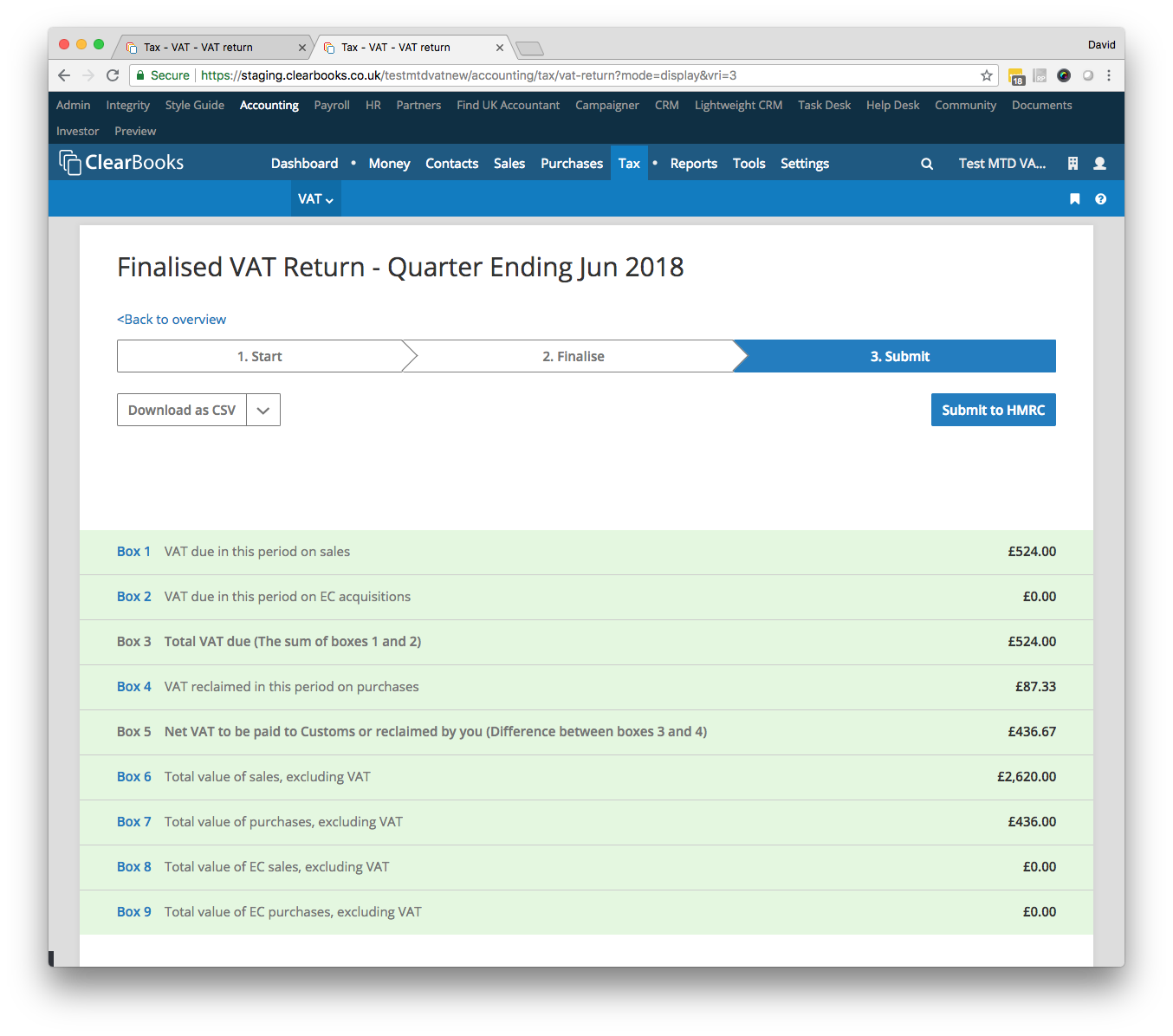

Once these changes come into effect, you'll no longer be able to manually enter your VAT return via the existing HMRC portal. Instead, you'll have to use recognised software to submit the return for you.

Clear Books is HMRC recognised MTD software. We have already completed live VAT returns as part of the Government's pilot programme and are experts at managing the change.

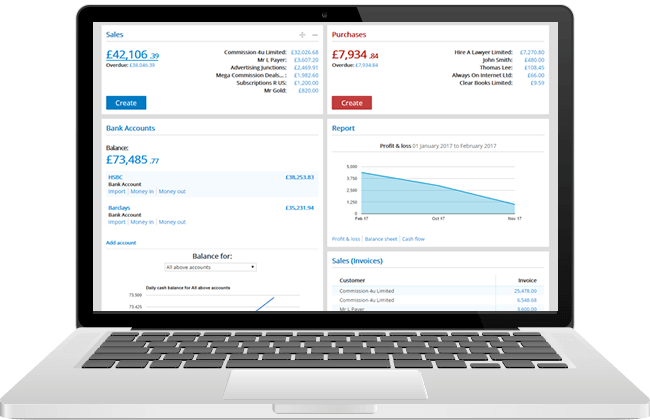

Clear Books Large is a feature rich accounting system.

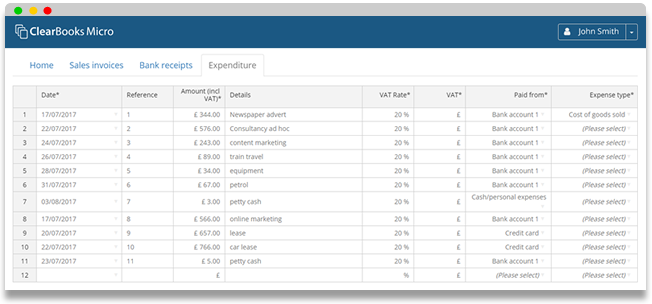

Clear Books Practice Edition provides an online spreadsheet for client data entry.

Your client enters income and expenses into the simple Micro spreadsheet

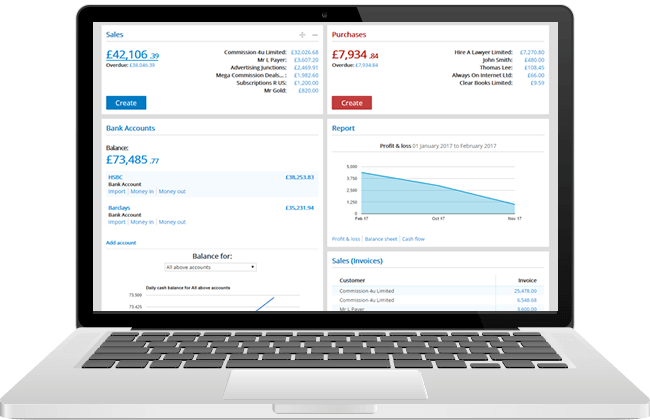

You see the data in the functionality-rich Practice Edition interface and make adjustments

You can submit quarterly MTD VAT returns directly from Practice Edition to HMRC

Clear Books, accredited by The Institute of Certified Bookkeepers and registered with the Financial Conduct Authority (reg. no. 843585), delivers valued, comprehensive online accounting software for small businesses in the UK.