Clear Books is an easy tool for small business based in the UK. Look professional when you customise our invoice templates with your logo and brand colours.

Select a ready-made template

Choose a template and get creative with your logo and colours.

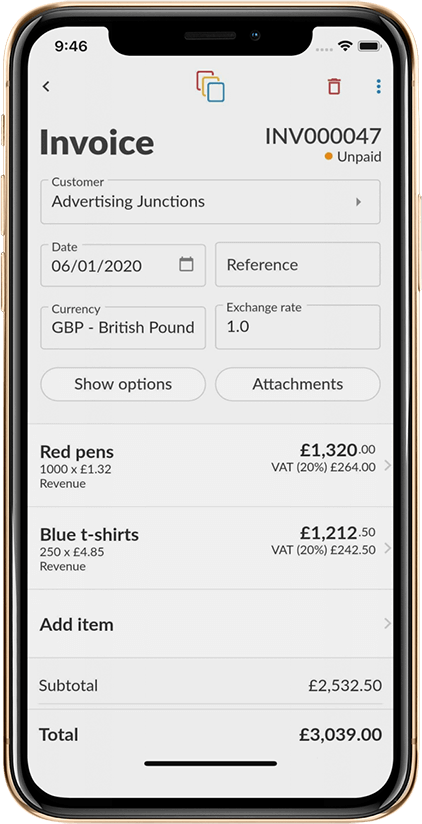

Raise invoices that automatically calculate totals and tax

Enter items into the invoice, and relax knowing the software automatically calculates tax and total prices.

Send your invoice by email

Be confident that your invoicing work is done when you send and track invoices directly from Clear Books.

Download invoices as a PDF

You're in control with Clear Books. If you wish to download your invoices and save them outside the system, it's easy to do.

Automatically file and organise invoices

Stay calm, knowing that you will always be able to find, edit, resend or download the invoices you create with Clear Books.

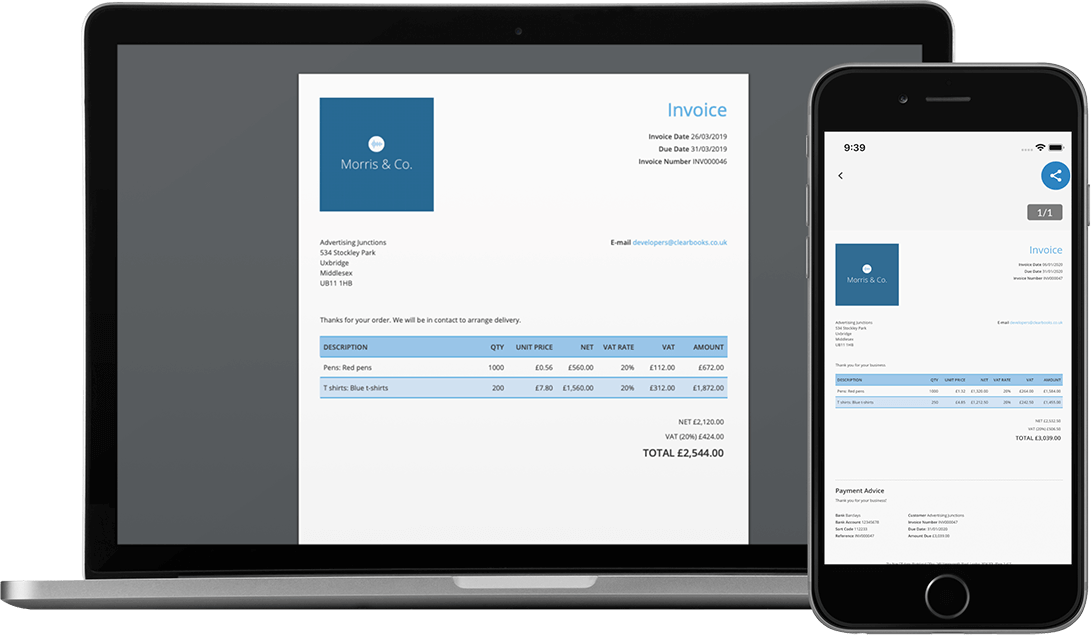

Invoicing on the website or mobile

Clear Books provides a complete invoicing solution - no matter whether you're in the office or on the go.

Feel at ease with our invoice automation tools:

Feel organised when your invoices are automatically generated and sent by Clear Books. Set up recurring invoices and we'll send a new invoice to your customer without you lifting a finger.

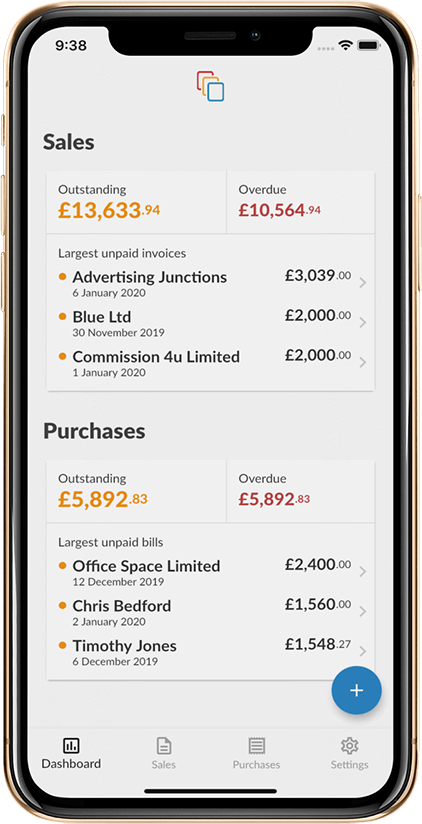

Stay in control of your debtors by asking Clear Books to chase your unpaid invoices.

Accept payments in 1 click

Integrate Clear Books with your GoCardless, PayPal or Stripe account to quickly accept credit or debit payments from customers.

Instantly accept payments with Instant Bank Payments, from your invoices and your mobile.

Mark invoices as paid when you import bank transactions

Complete your invoicing by matching your bank transactions with invoices. Clear Books will mark items as paid, outstanding or overdue so you don't need to track their status.

Accelerate your payments with ease by offering Instant Bank Payments as a payment option on your invoices.

With this feature, your customers can pay you quickly and easily via bank transfer by simply clicking on the payment button that will be added automatically to your invoices. This seamless process saves you and your customers time and hassle, ensuring faster payments and improved cash flow for your business.

Take the first step towards faster payments by adding Instant Bank Payments to your invoices today!

No matter what type of business you run, you can feel at ease with Clear Books invoicing software.

VAT registered businesses can set the VAT rate to apply to each item on an invoice. Clear Books will automatically calculate the VAT and total, so you know the invoice is accurate. Learn more about Clear Books' VAT features here.

CIS registered businesses can set the CIS rate for each subcontractor, or apply the Domestic Reverse Charge. Learn more about Clear Books' Construction Industry features here.

If you import or export, Clear Books has you covered. Raise invoices in any currency and watch Clear Books automatically calculate the exchange rate. It's all part of our free integration with XE.

Clear Books, accredited by The Institute of Certified Bookkeepers and registered with the Financial Conduct Authority (reg. no. 843585), delivers valued, comprehensive online accounting software for small businesses in the UK.