Create invoices, track purchases and manage bank transactions with Clear Books. We will transform your business data into a range of easy-to-understand business reports.

Use them to clearly understand your business operations and make data-driven decisions.

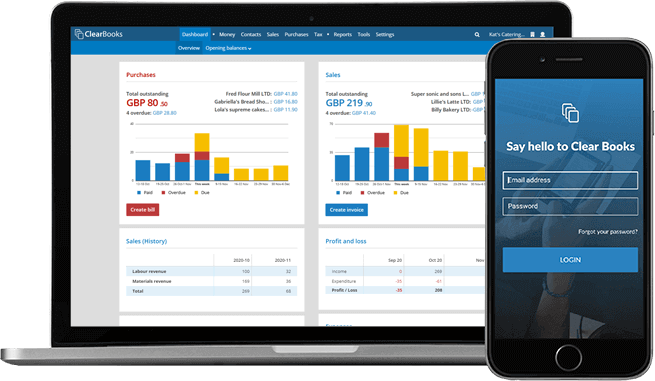

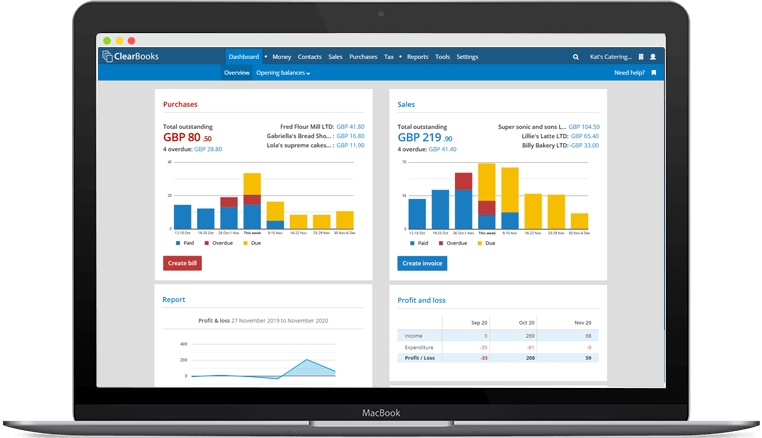

Get clarity quickly. Clear Books' handy dashboard shows your outstanding invoices and bills, your bank balance, and tax you owe building up.

With graphs and traffic-light insights on your dashboard, easily keep on top of your business finances and see upcoming bills due, money coming in, and if you might be heading towards a future cash flow problem.

Choose your preferred dashboard information so what you need is always on hand.

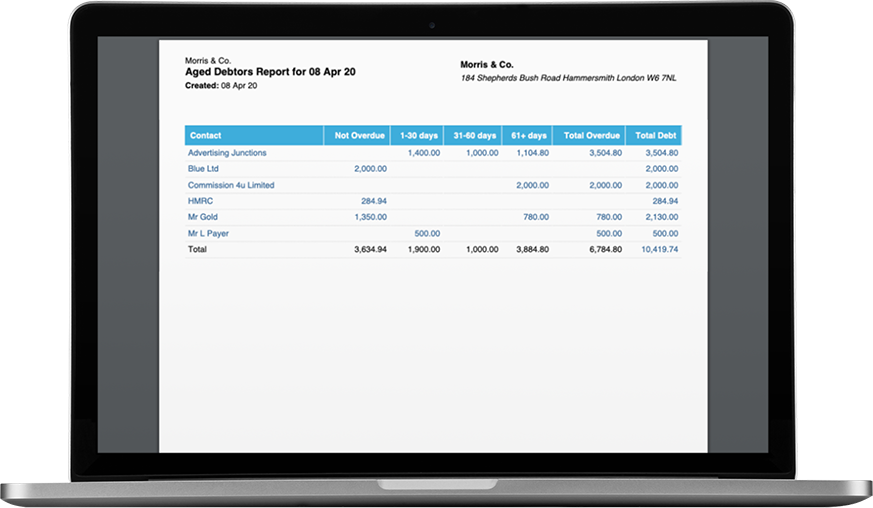

Create invoices with Clear Books. When you do, we will automatically add the invoice to an 'aged debtors' report showing you when all your outstanding invoices fall due.

You can then auto-import your bank transactions to Clear Books, matching customer payments with outstanding invoices. You'll be able to easily see who you need to follow up for payment.

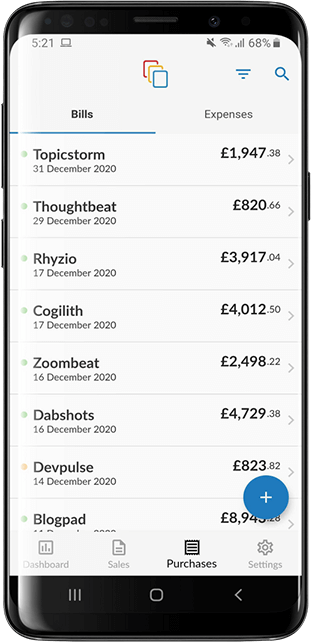

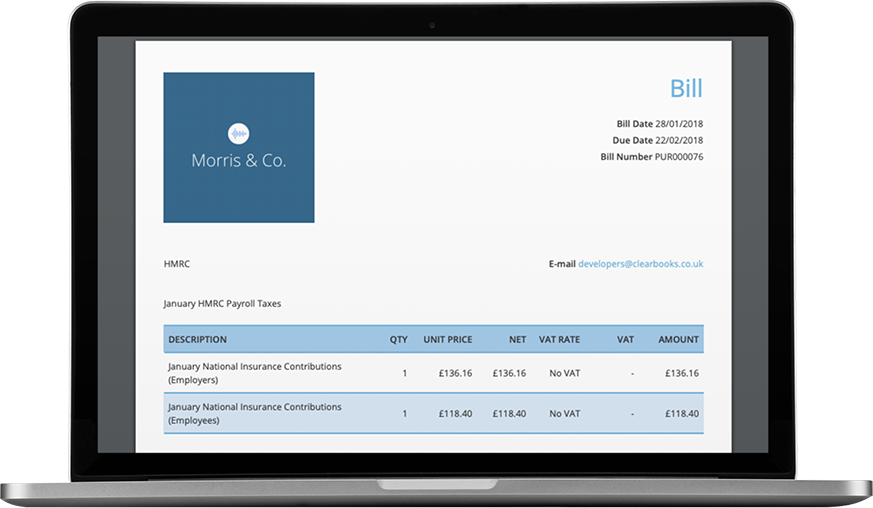

Enter business bills into Clear Books when you receive them. We will automatically create an 'aged creditors' report showing you when each bill falls due.

Then, all you need to do is match your auto-imported bank transactions to each bill as you pay them. That way, you'll know exactly what bills are upcoming next.

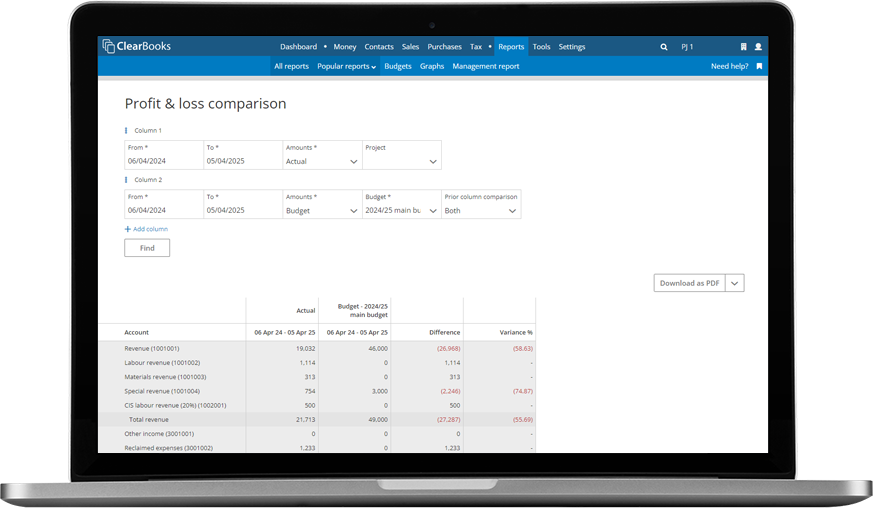

Whether you want to know the financial position of your business (balance sheet), or the amount of profit you've made (profit and loss), Clear Books is the accounting and business reporting tool you need.

All of our easy reports can also be downloaded as a PDF for review, or a CSV if you want to analyse them in Excel.

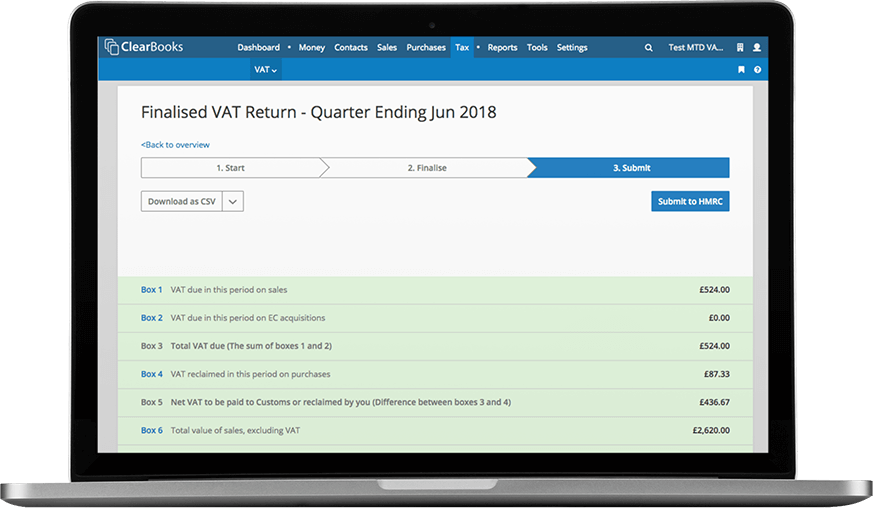

Clear Books links directly with HMRC. You can submit Making Tax Digital (MTD) VAT returns directly to HMRC in minutes.

Plus, if you're a construction sector business, you can compile and submit CIS returns, with downloadable statements to give subcontractors.

If you're after a specific type of report - we offer a range of options, here are just a few!

Popular with accountants. Gives a summarised list of all account code transactions over a period.

Details all money in and all money out across all your bank accounts. A very important report to sense check the health of your business.

List of all invoices in a date range that can be filtered by customer. It's a quick way to answer customer questions about their upcoming payments.

See the profit or loss you made for each project you worked on. You'll know which projects are most lucrative for you.

Report comparing the margin in a selected period versus the margin in a comparative period for selected account codes.

The Management Report brings together data from all areas of your account into one convenient PDF report to provide a complete overview of your business.

Budgeting and project tools enhance your reporting by providing rich insights into financial performance for each project. Easily track your budget versus actual spending, ensuring projects stay on financial target. With comprehensive reporting, you can monitor the profitability of individual projects and make informed decisions to optimise your business's financial health.

Clear Books, accredited by The Institute of Certified Bookkeepers and registered with the Financial Conduct Authority (reg. no. 843585), delivers valued, comprehensive online accounting software for small businesses in the UK.