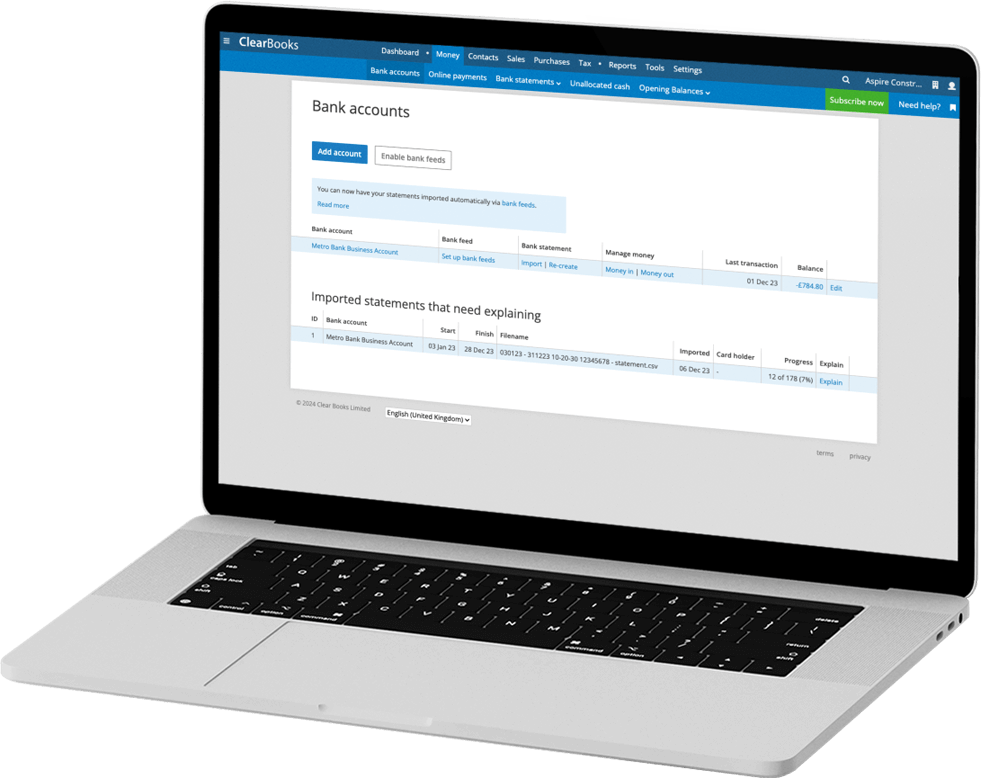

At Clear Books, our mission is to free you from tedious admin. In just one click, watch as your bookkeeping is effortlessly completed by our advanced AI technology.

Imagine the joy of having all that extra time back – time to grow your business, pursue your passions, or simply relax.

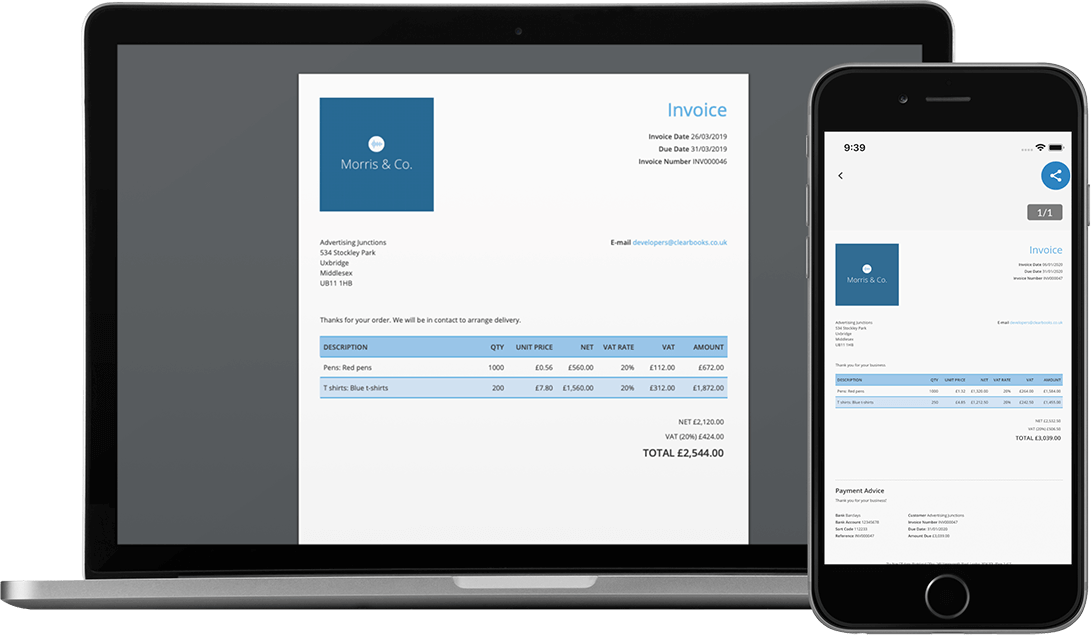

Craft stunning, professional invoices effortlessly using Clear Books. Convenient, automated payment reminders ensure your customers always pay on time.

Make it easy for your customers to pay with flexible online payment options, including credit cards and bank transfers.

Call 0203 475 4744

Benefit from unlimited access to our friendly and knowledgable UK-based support team. Our experts are ready to assist with any email and telephone queries you may have.

Clear Books is award-winning online accounting software designed for UK small businesses.

Clear Books is the chosen bookkeeping software for thousands of businesses in the UK, including limited companies, self-employed sole traders and partnerships. From construction and IT & tech to retail, property management, business services, consulting, and transportation, our intelligent accounts software seamlessly adapts to your industry.

Versatile AI-powered features serve more nuanced industries. Capabilities include multi-currency accounting software, CIS accounting software, and integrated payroll software. It's why hundreds of accountants recommend Clear Books as the 'accountant' accounting software of choice.

Clear Books, accredited by The Institute of Certified Bookkeepers and registered with the Financial Conduct Authority (reg. no. 843585), delivers valued, comprehensive online accounting software for small businesses in the UK.