HMRC requires all small businesses earning more than £90,000 a year to keep digital records and submit VAT returns via recognised software.

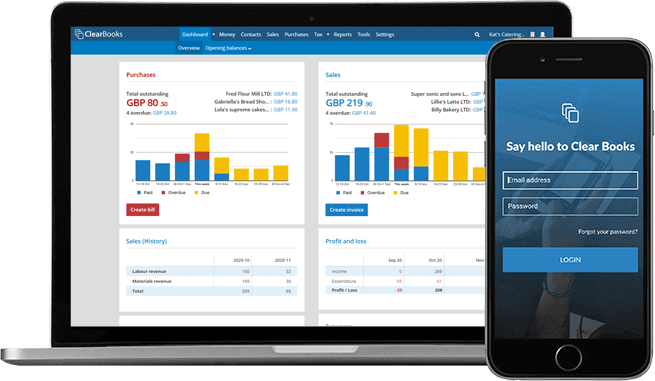

Clear Books is HMRC recognised software that ensures you comply with these rules. Create, review and submit VAT returns in 3 easy steps with Clear Books.

Be confident you comply with HMRC rules. Clear Books is recognised by HMRC as Making Tax Digital ready software.

We are listed on the HMRC's Making Tax Digital software list, and help thousands of small businesses complete online VAT returns each month, quarter or year.

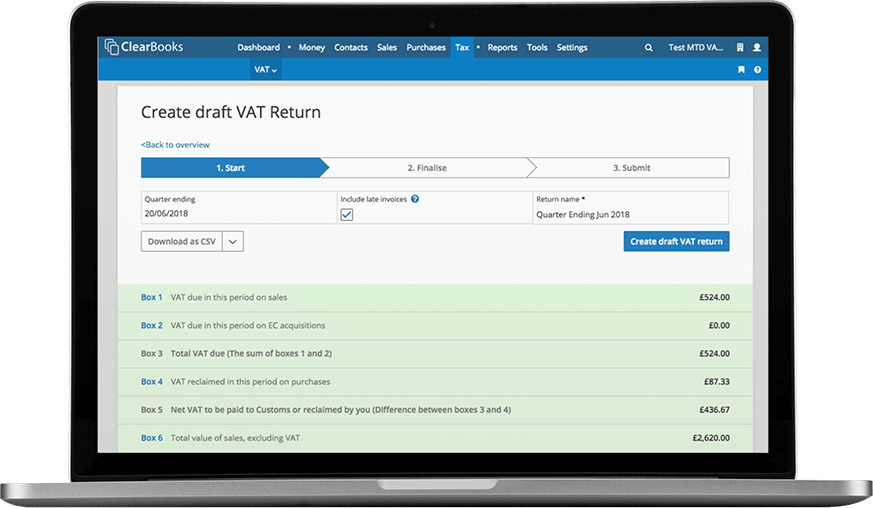

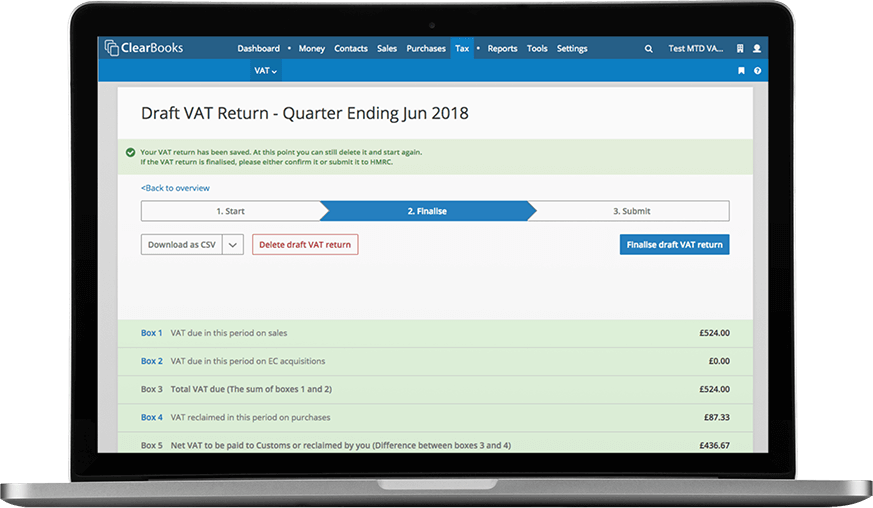

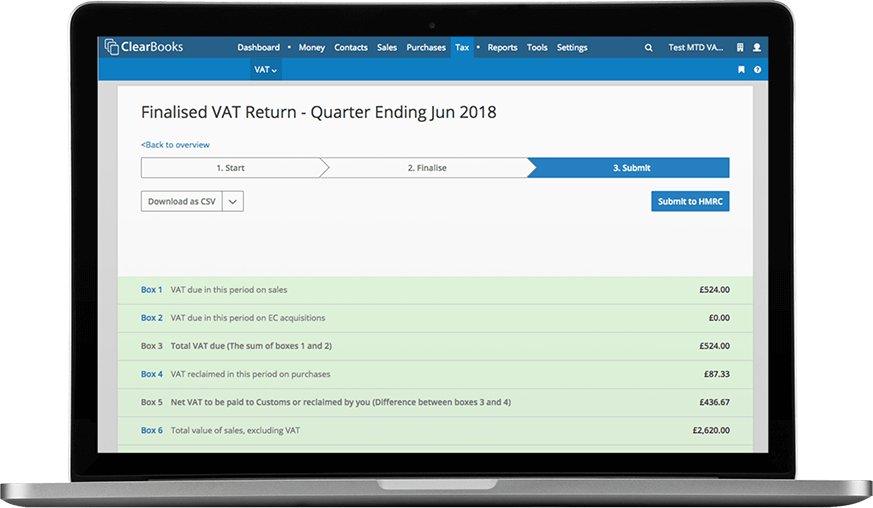

Clear Books VAT returns take 3 simple steps:

1. Track your sales and purchases

2. Select your VAT return dates

3. Review the 9 box return that is generated for you and submit it directly to HMRC.

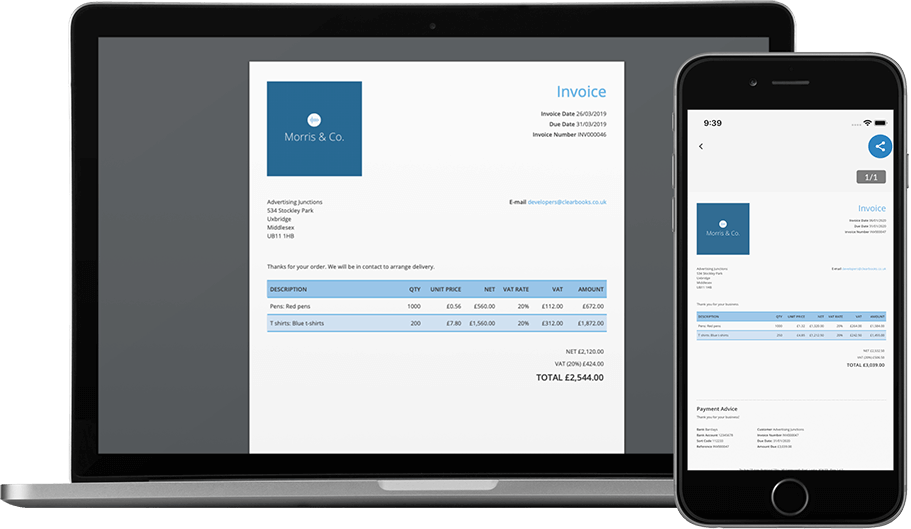

Clear Books VAT accounting software will automatically apply fixed or variable rates of VAT to your invoices.

Simply raise an invoice, and the VAT calculation is done for you. Every invoice you raise is automatically included in your monthly, quarterly or annual VAT return to save you a lot of extra work.

Track the VAT you wish to claim back on purchases. Simply take photos of receipts with the Clear Books app, and we will read the text in the photo, creating a record for you to review and save.

If you want to track bills manually, you also have the option to type them in, using our easy 'bills' form.

Clear Books calculates and displays the VAT debt you're building up so you can ensure you've always cash available to pay your VAT bill. At a glance, you'll know how much you're likely to owe when you submit your return.

And, if you want more detailed reports, Clear Books will automatically generate popular reports for you to review and analyse.

Clear Books, accredited by The Institute of Certified Bookkeepers and registered with the Financial Conduct Authority (reg. no. 843585), delivers valued, comprehensive online accounting software for small businesses in the UK.