Clear Books' secure bank feeds update daily so you can see all your bank transactions in Clear Books. You can see many bank accounts in one place, without needing to log into online banking.

View these transactions to easily create sales and purchase records and see a complete picture of your business finances.

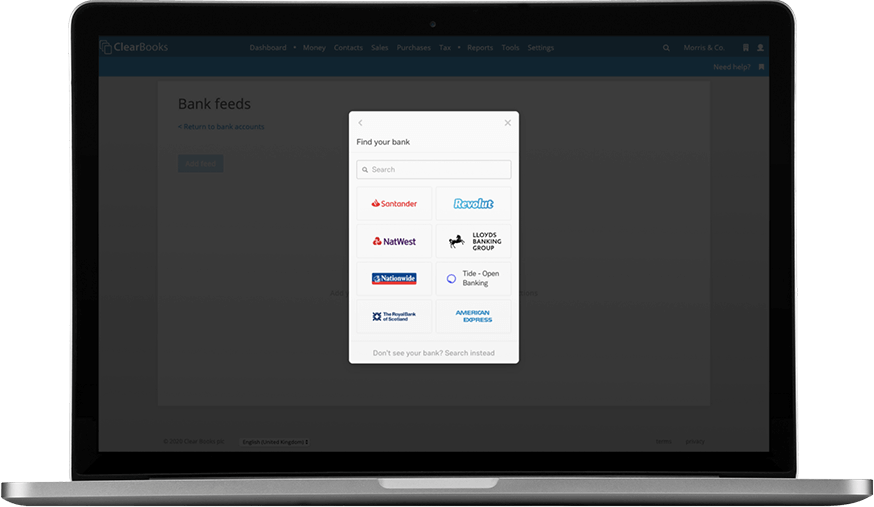

Clear Books' secure bank feeds import your transactions up to 4 times a day. We connect with hundreds of banks, and are adding more all the time.

Bank feeds are included with all Clear Books subscription options, so you know that you'll never have to pay more for quick and easy accounting.

Clear Books will automatically import your bank transactions. All you need to do is match the payment with the invoice to mark it as paid.

Clear Books bank feeds will help you keep track of your daily takings. When Clear Books imports your bank transactions, simply categorise your takings as revenue, and we'll display your sales on your dashboard.

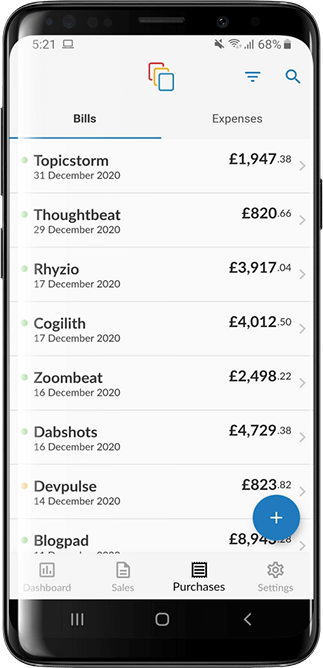

Whether you make purchases using your card or direct debit, Clear Books bank feeds will show you what you've spent. Simply categorise each transaction to keep track of your bills, receipts and recurring direct debits.

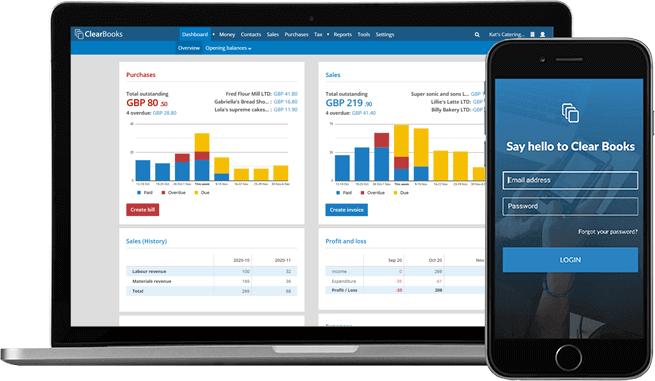

When you reconcile your bank accounts with Clear Books, our dashboard shows you business-critical information (like outstanding bills and overdue invoices).

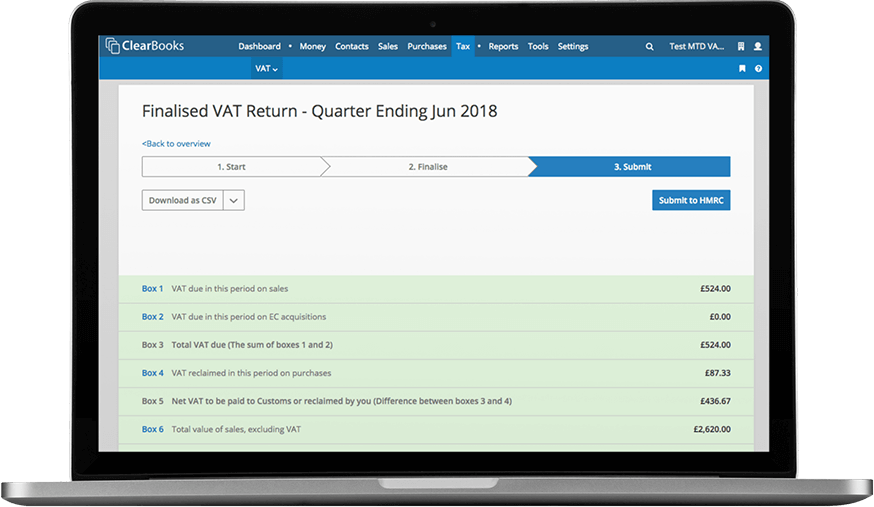

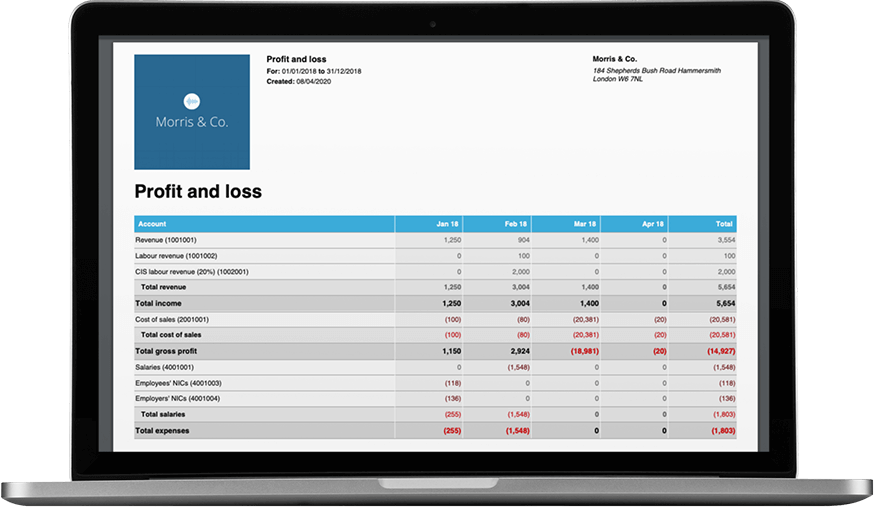

If you’re after more in-depth information, all your financial data is automatically compiled into reports including a P&L, Balance Sheet, Aged Debtors and Creditors, as well as HMRC recognised MTD VAT returns.

Clear Books' advanced automation tools make bank reconciliation easy:

Clear Books, accredited by The Institute of Certified Bookkeepers and registered with the Financial Conduct Authority (reg. no. 843585), delivers valued, comprehensive online accounting software for small businesses in the UK.