Manage bulk payroll with ease, submit directly to HMRC and reduce your admin with Clear Books.

or call 0800 862 0202

As an accountant managing payroll for multiple clients, you need a reliable, time-saving, and compliant tool that ensures accuracy every time. Clear Books Payroll is built to help you run client payrolls seamlessly, handle complex calculations with ease, and meet your regulatory requirements - all in one platform.

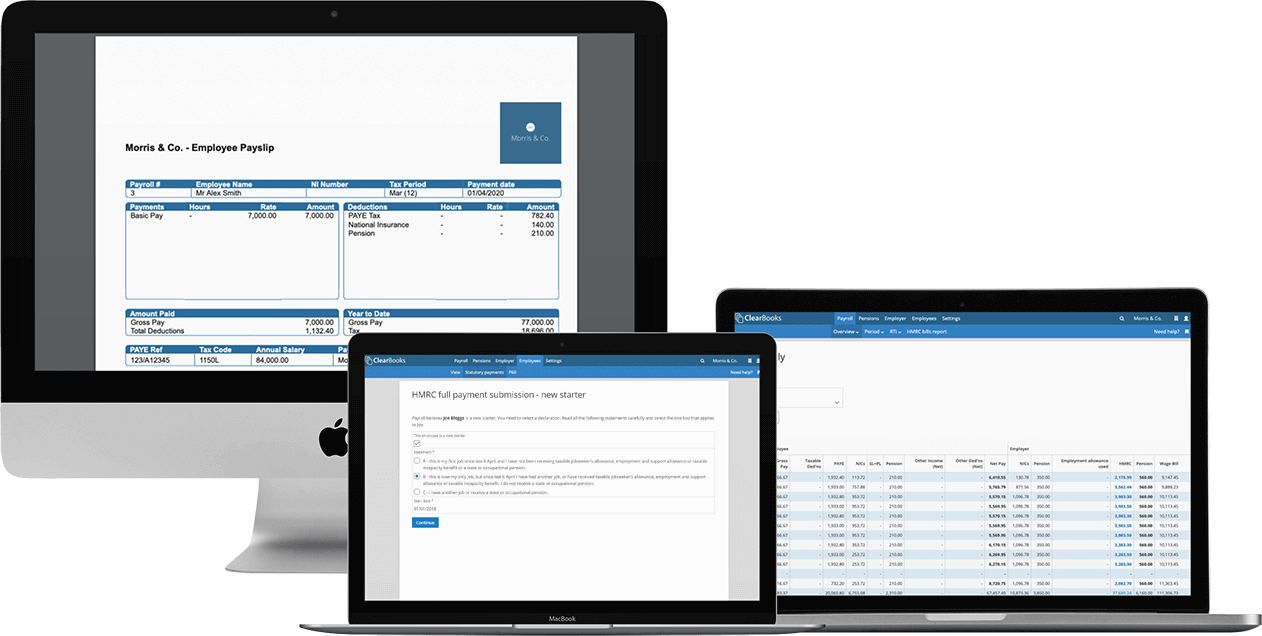

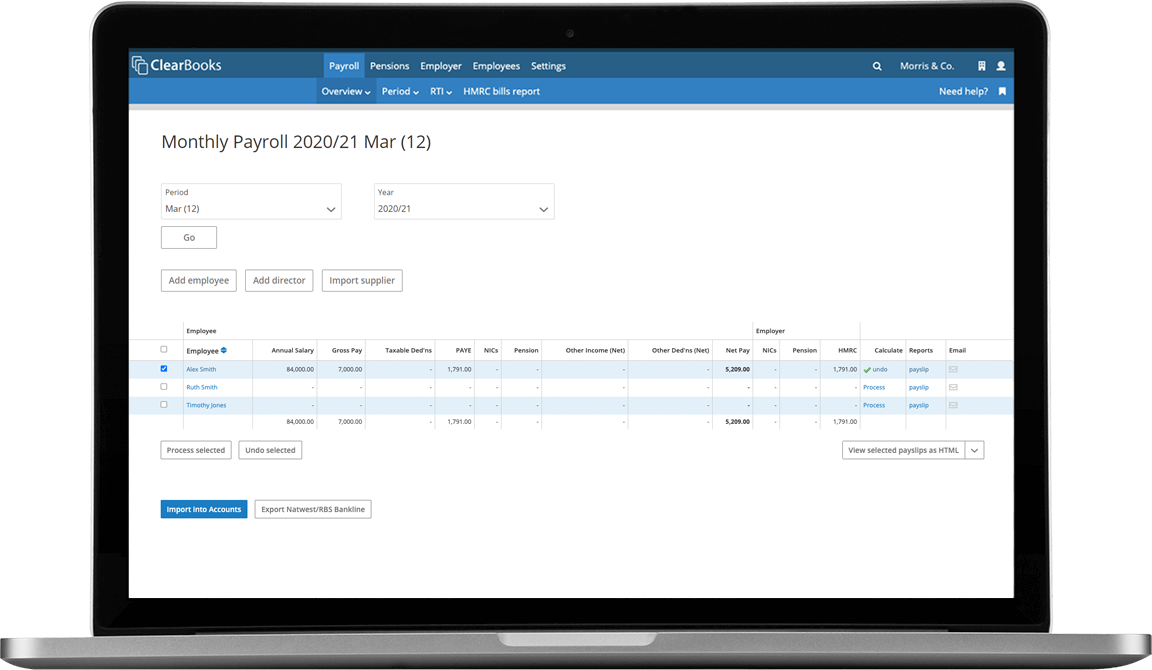

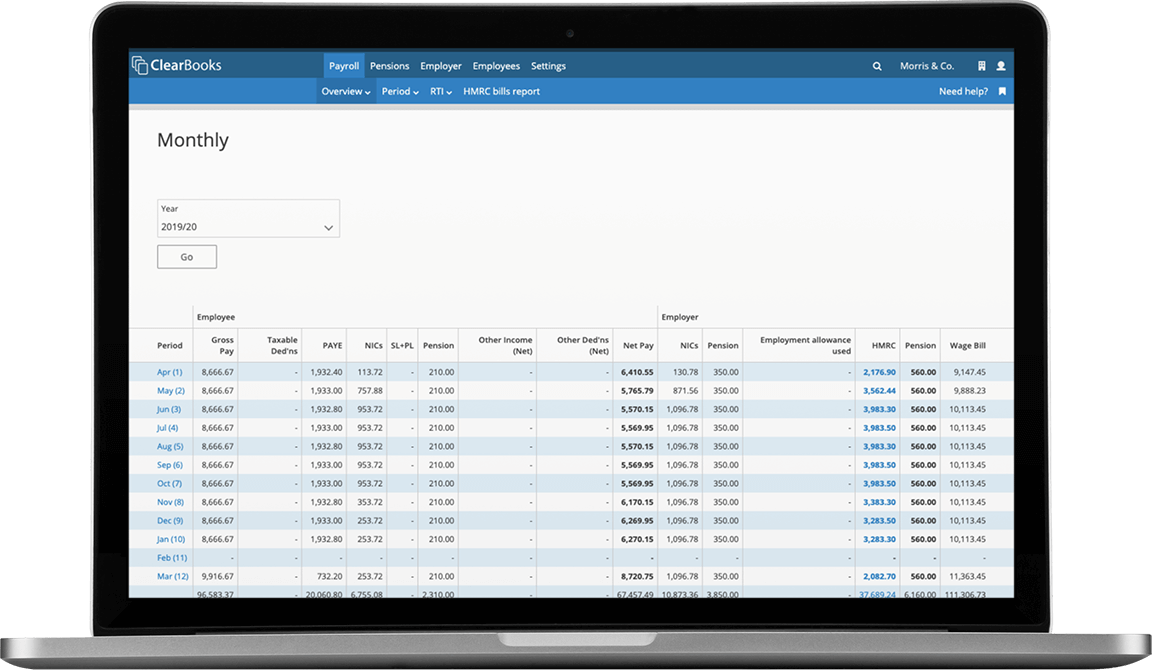

Manage payroll for all your clients in a single, user-friendly system. Bulk-run payroll, generate payslips, and file HMRC returns at the click of a button - perfect for busy payroll bureaux and accountancy firms.

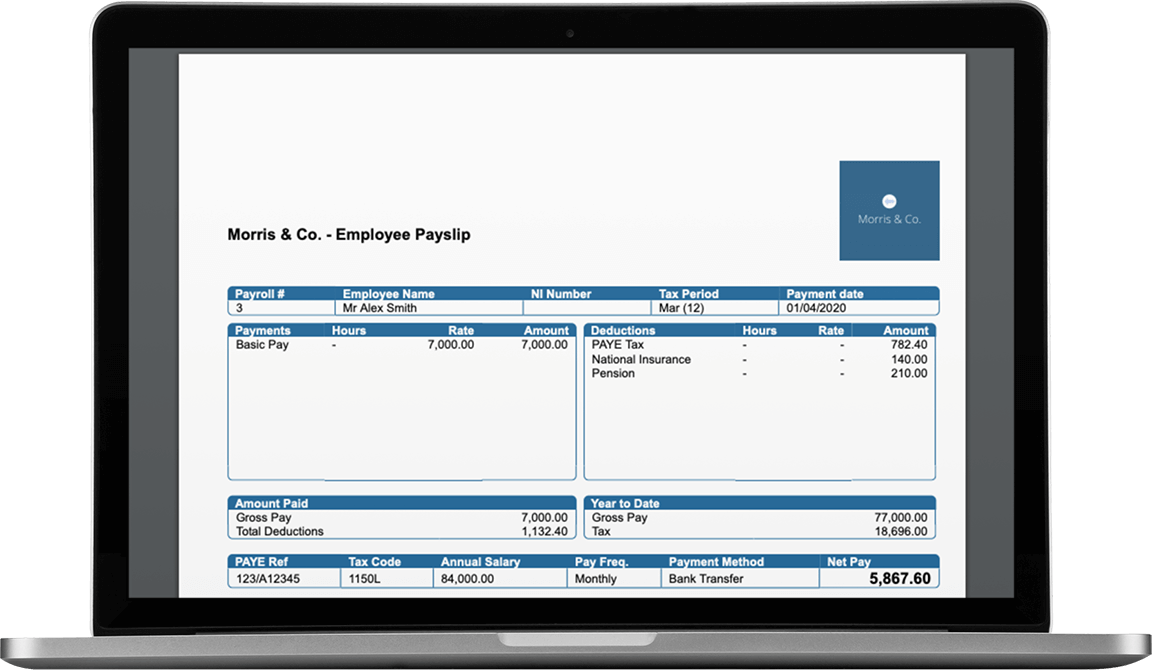

No more manual data entry or complex spreadsheets. Clear Books automatically calculates PAYE, National Insurance, student loans, salary sacrifices, and other deductions. With support for multiple pay frequencies (weekly, fortnightly, monthly, quarterly, and annually), you can swiftly process payroll for various client requirements.

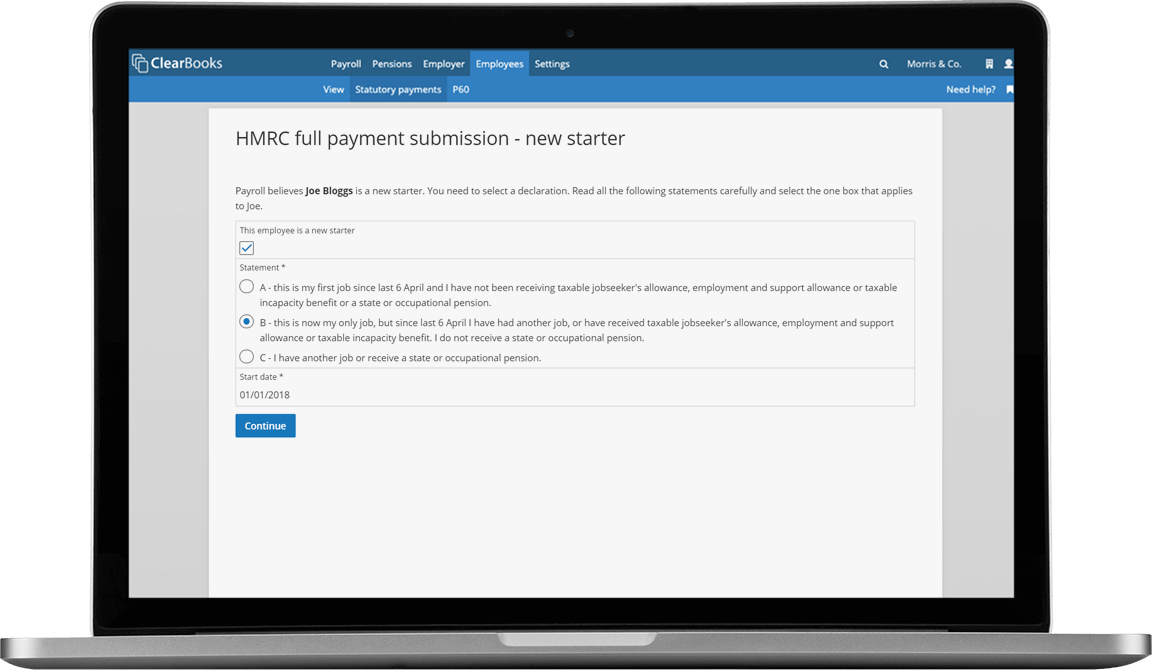

Stay confident with HMRC-recognised payroll software. Submit Real Time Information (RTI) directly, including Full Payment Submissions (FPS) and Employer Payment Summaries (EPS). Generate compliant payslips, P45s for leavers, P11s, and P60s at year end without lifting a finger.

Enhance your clients’ branding by adding their logos and custom colours. Show additional pay items and deductions (e.g. bonuses, overtime, pension contributions) before or after tax. Once everything’s set, send out payslips securely via email or through the online employee portal, with the option to schedule automatic sends.

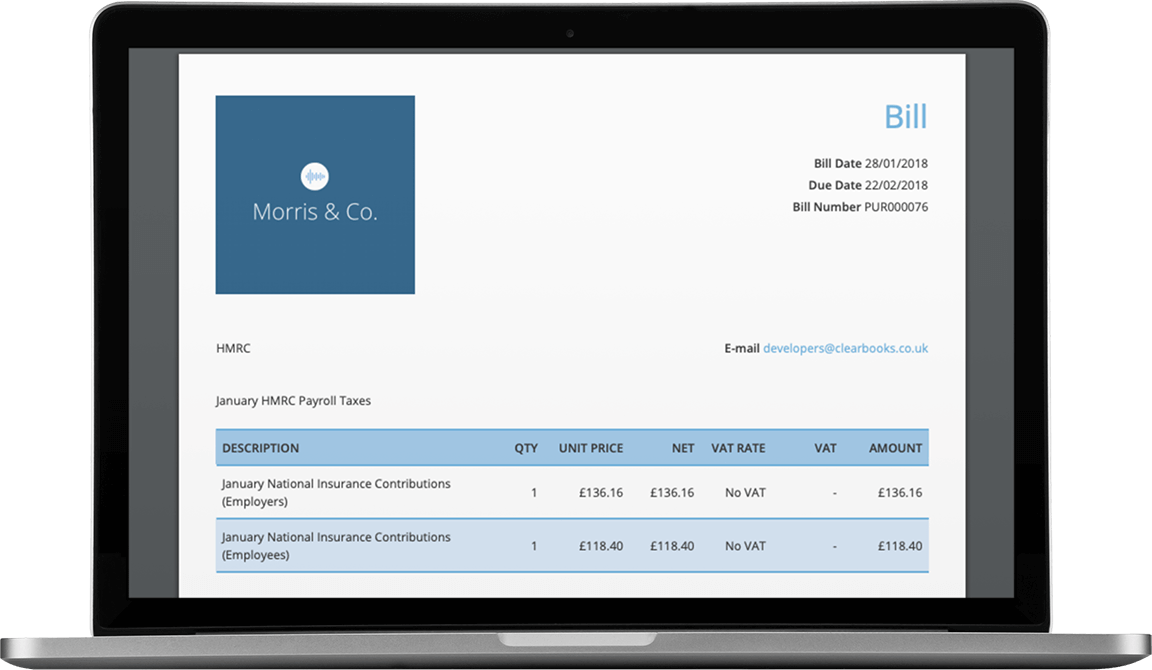

Connect Clear Books Payroll seamlessly with Clear Books Accounting. Each time you run payroll, the software creates bills or journals for employee wages, HMRC, and pension payments automatically - saving you time on bookkeeping.

Send payment files to Revolut Business Banking or NatWest and RBS Bankline, making large multi-employee payments quick and straightforward.

Setting up your firm? Contact us to learn about our exclusive offer for new-to-practice accounting and bookkeeping firms. Book a free, no-obligation demo to learn more.

Our online accounting software is award-winning and industry-accredited, so you can be confident that Clear Books will deliver for you. Don't just take our word for it - read what our accountant partners are saying about Clear Books:

Need to switch a client to Clear Books Payroll mid-year? No problem! Import all employee year-to-date figures, tax codes, and other key details in bulk to ensure accuracy. Easily submit FPS and EPS returns without gaps or inaccuracies. Our UK-based support team and step-by-step guides will be on hand to help you every step of the way.

Clear Books, accredited by The Institute of Certified Bookkeepers and registered with the Financial Conduct Authority (reg. no. 843585), delivers valued, comprehensive online accounting software for small businesses in the UK.