Sole traders and people with income from property will need to follow new HMRC rules under Making Tax Digital (MTD).

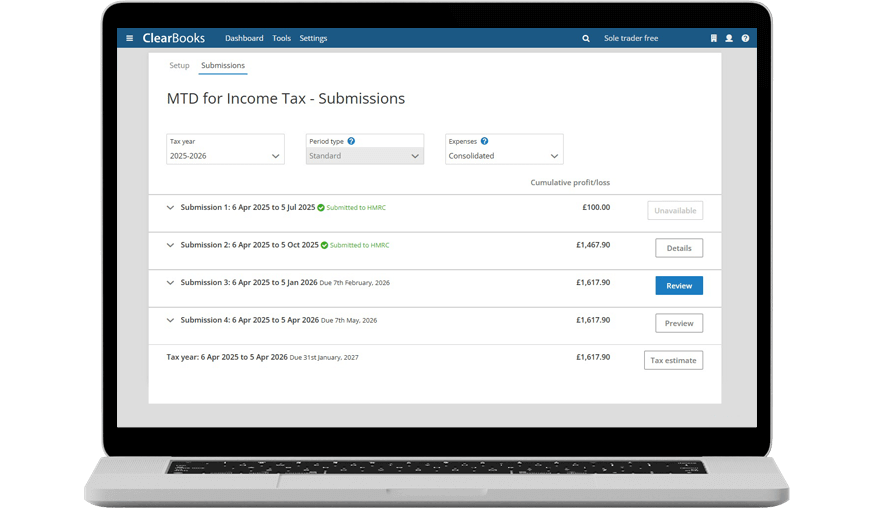

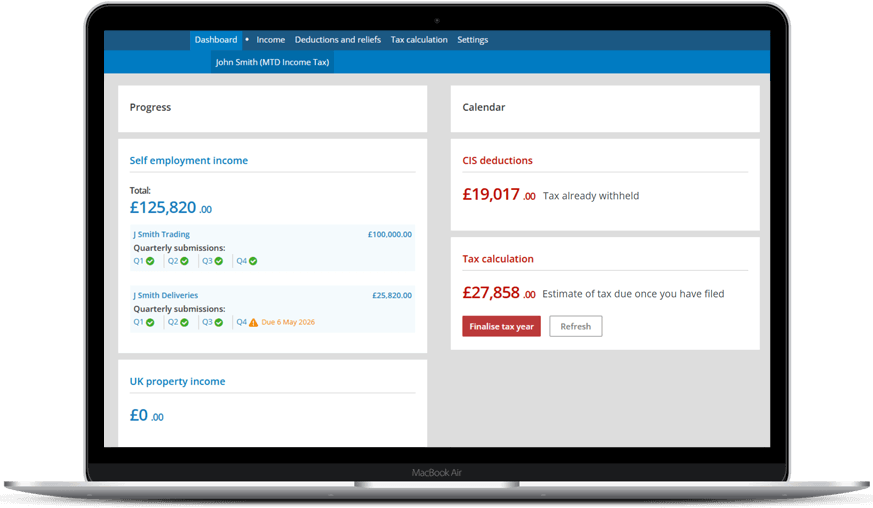

That means keeping digital records and sending quarterly updates to HMRC instead of filing a single annual tax return, using HMRC-registered software.

Clear Books makes it simple - and keeps you compliant.

MTD means sole traders and people with income from property have to record their revenue and costs in registered software, like Clear Books.

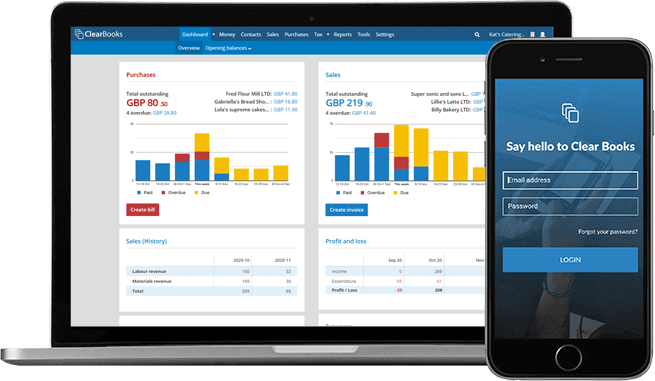

Categorise income and expenses your way, online or on the mobile app – no spreadsheets, no stress.

Stay compliant by sending your updates to HMRC each quarter.

Clear Books walks you through each step so you know exactly what’s due – and when.

When the tax year ends, easily finalise your figures and submit your MTD tax return to HMRC – all online, all in one place.

Clear Books helps you stay compliant with Making Tax Digital (MTD) and makes running your business easier with simple, HMRC-recognised bookkeeping tools.

If you earn income from UK or overseas property—whether you manage it yourself or use an agent—Clear Books makes it easy to stay on top of your records and MTD obligations.

With thousands of customers and rated ‘Excellent’ on Trustpilot, Clear Books is a long-standing trusted provider of accounting software for UK sole traders.

Clear Books is award-winning online accounting software designed for UK small businesses.

Clear Books, accredited by The Institute of Certified Bookkeepers and registered with the Financial Conduct Authority (reg. no. 843585), delivers valued, comprehensive online accounting software for small businesses in the UK.