Clear Books Practice Edition with Micro spreadsheet is for less tech-savvy clients. If you still have clients using spreadsheets or bringing you shoeboxes of receipts, Micro is a simple data entry tool to get income and expense data into a digital record. Data entered into Clear Books Micro is automatically uploaded into Clear Books Practice Edition, our feature-rich online accounting tool for accountants and bookkeepers.

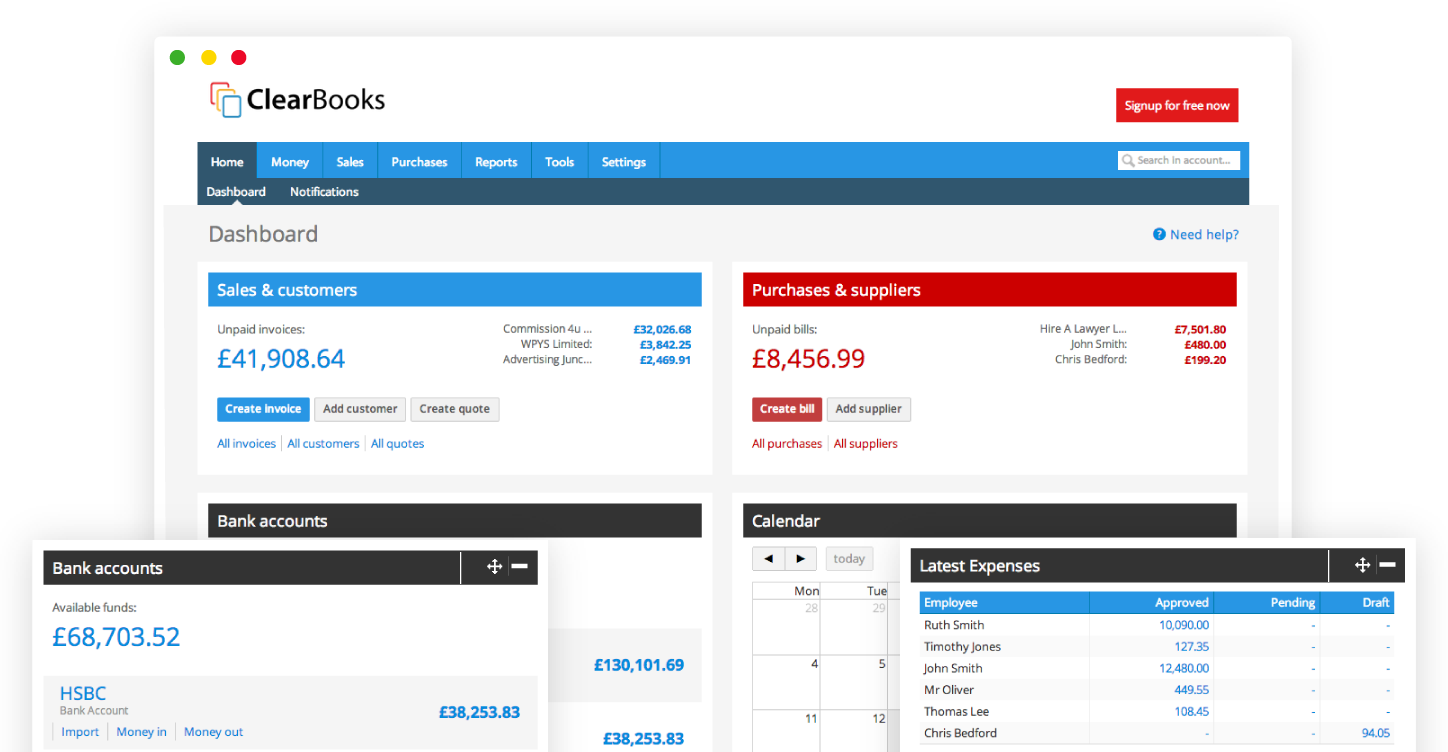

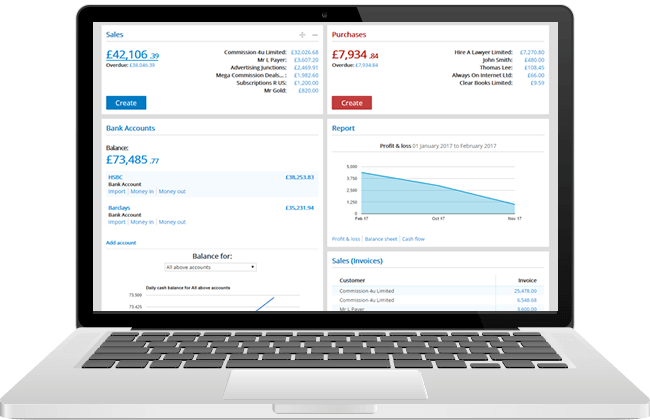

For your more involved clients, Clear Books Large is the answer. Subscribers to Clear Books Large have full system access for both the accountant, bookkeeper and client.

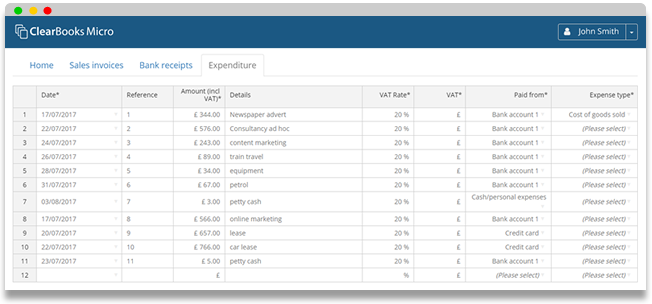

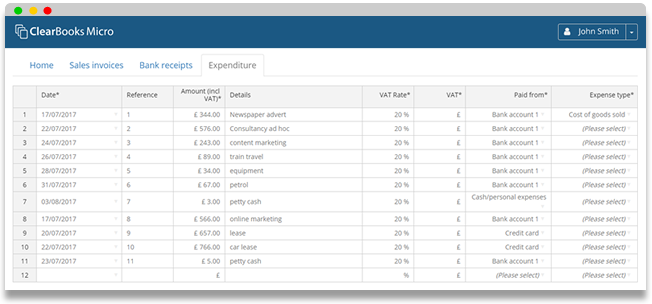

Your client enters income and expenses into the simple Micro spreadsheet

You see the data in the functionality-rich Practice Edition interface and make adjustments

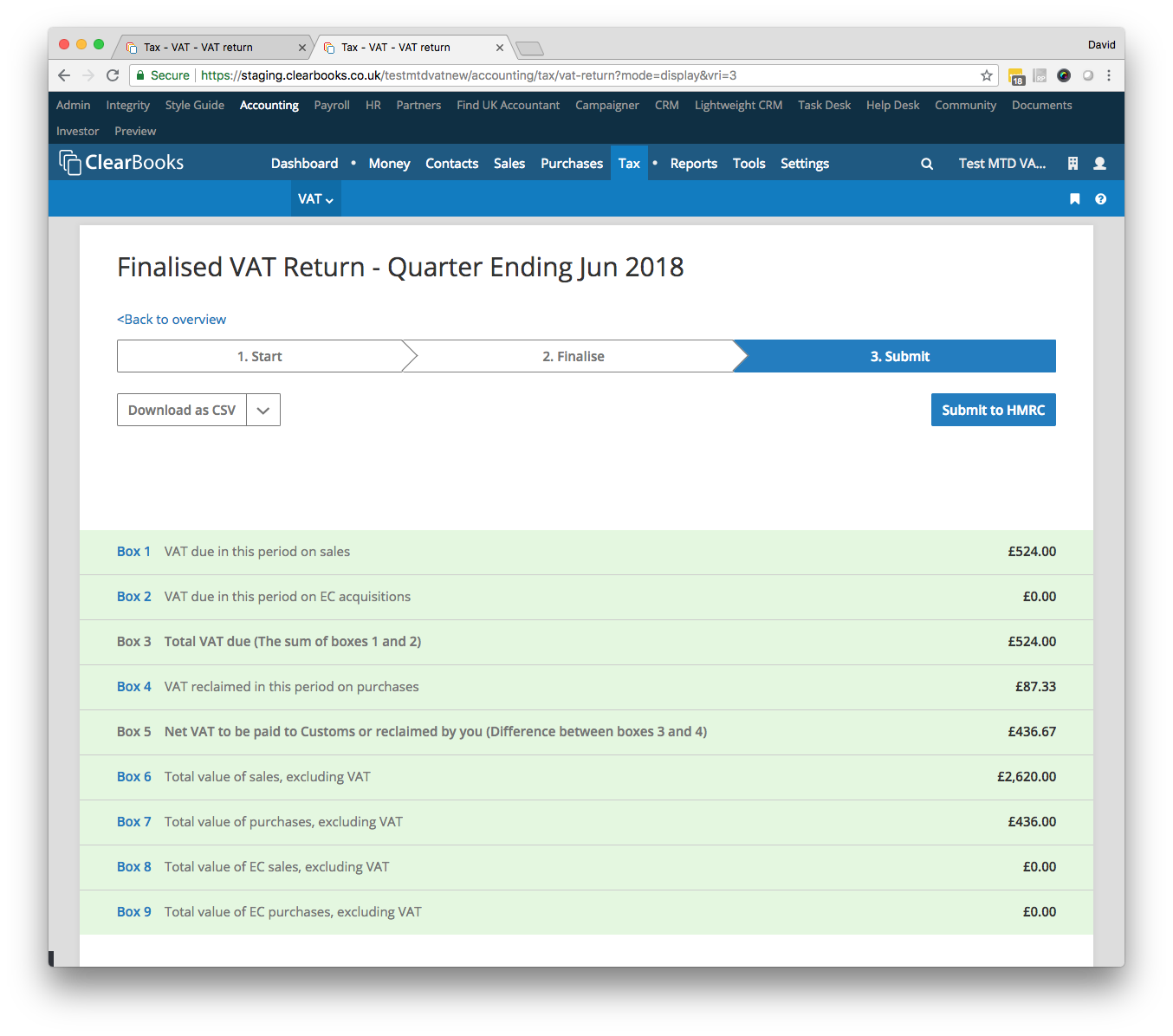

You can submit quarterly MTD VAT returns directly from Practice Edition to HMRC

Clear Books, accredited by The Institute of Certified Bookkeepers and registered with the Financial Conduct Authority (reg. no. 843585), delivers valued, comprehensive online accounting software for small businesses in the UK.