We will use your email address to share relevant updates with you. We will not sell or share your information. Unsubscribe at any time. For details see our privacy policy.

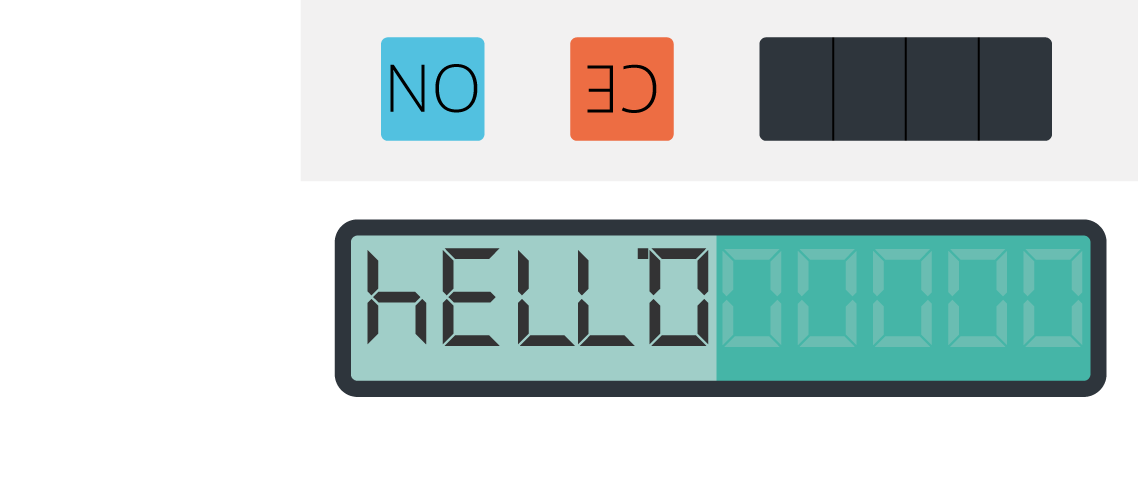

Submit VAT returns directly to HMRC through our small business accounting software.

Our Accounting app calculates all your tax and even sends VAT returns to HMRC automatically.

Clear Books, accredited by The Institute of Certified Bookkeepers and registered with the Financial Conduct Authority (reg. no. 843585), delivers valued, comprehensive online accounting software for small businesses in the UK.