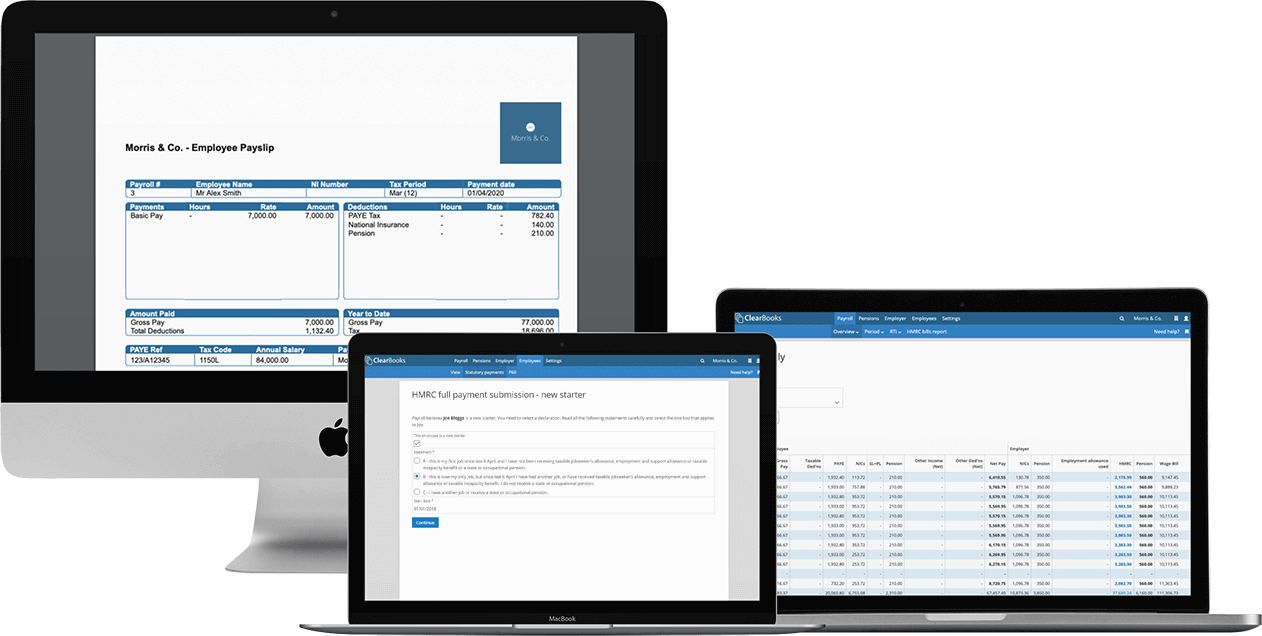

Clear Books provides combined Payroll and HR software that makes life easy. With Payroll you can calculate pay, send payslips, and report to HMRC. And, by giving your employees access to the HR portal they can request leave. It's easy.

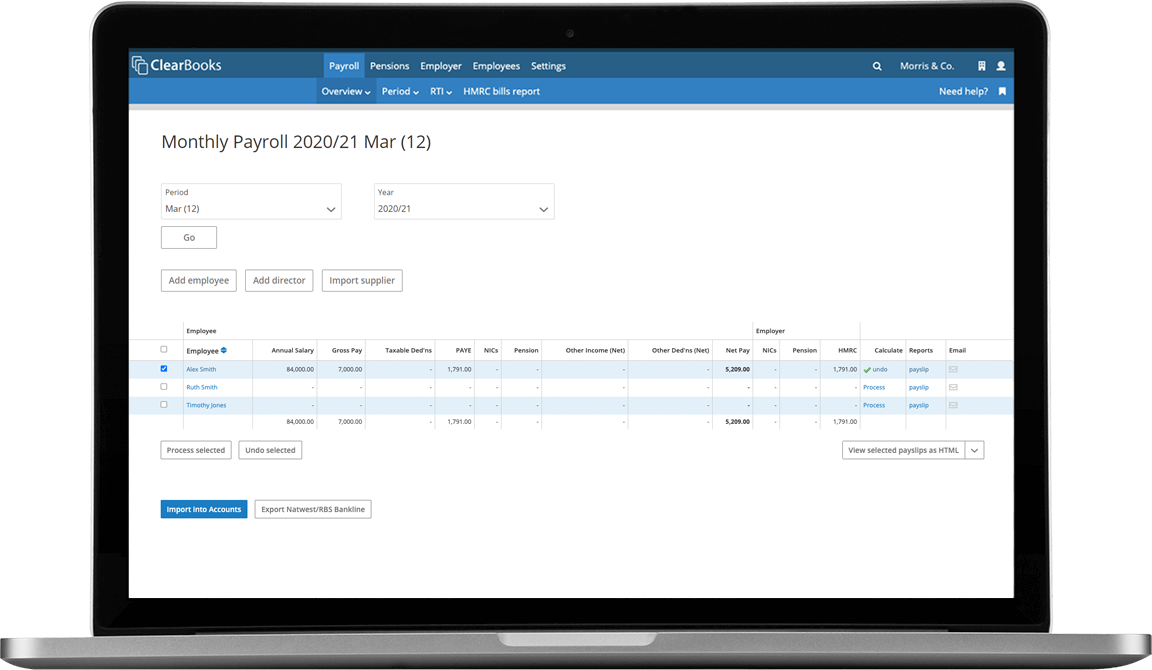

Save time and pay all your staff at once with our click-to-pay feature in Clear Books. No more copying and pasting of personal or bank account details, our software does it all for you so you can feel good knowing that Payroll is under control without spending hours on it.

Calculate pay for your employees in 3 easy steps:

1. Set up your employee(s)

2. Set weekly, fortnightly, monthly, quarterly or annual payments

3. Run payroll. Clear Books automatically calculates employee pay, tax, and other deductions.

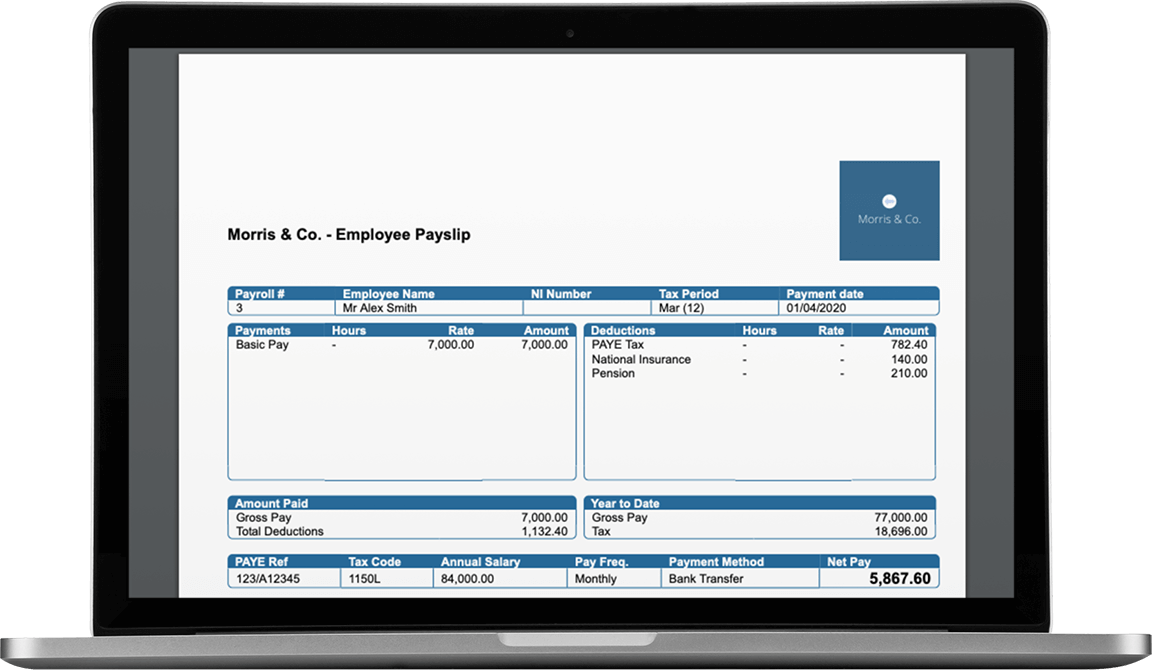

Customise payslips, P45s and P60s with your company's logo and colours. Once you're set up, producing forms takes just one click.

Send payslips to employees via email, print, or allow them to view forms online by granting access to the employee portal.

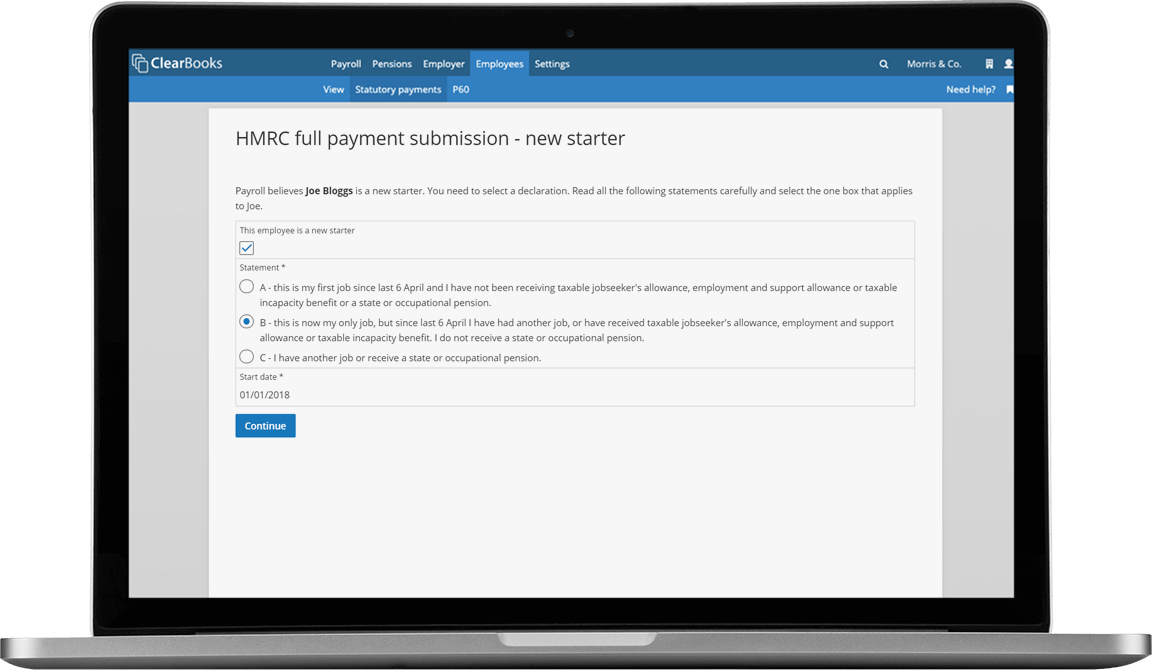

Clear Books links directly with HMRC. You can submit Real Time Information (RTI) with the click of a button.

Clear Books supports Employer Payment Summaries (EPS), and Full Payment Submissions (FPS), and we are a recognised payroll software supplier with HMRC. With Clear Books, you can be sure that your payroll compliance is in safe hands.

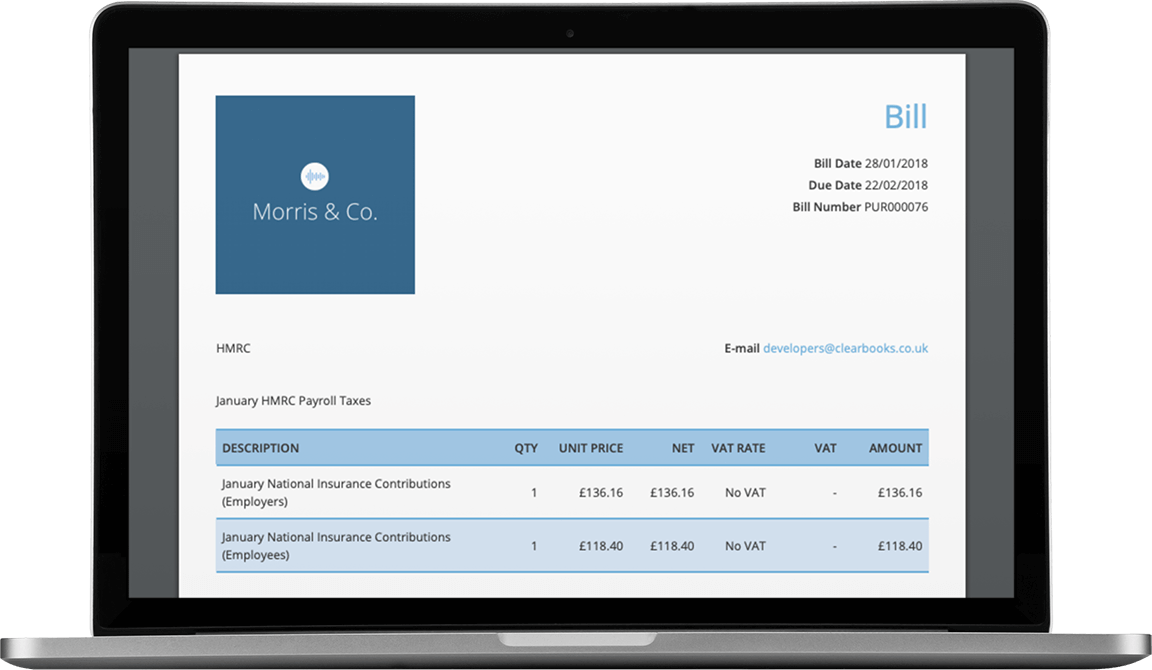

Clear Books payroll and Clear Books accounting are integrated. When you run payroll, Clear Books raises bills to pay for each employee and for HMRC. That way, you'll know what payments you should make in online banking, and your bookkeeping will be complete.

If you use NatWest or RBS Bankline, Clear Books makes online banking payments easy. Simply download a file from Clear Books, and upload it to NatWest or RBS. The payment file tells your bank your employee's bank details and the value of each payment. Payroll and payments will be completed quickly.

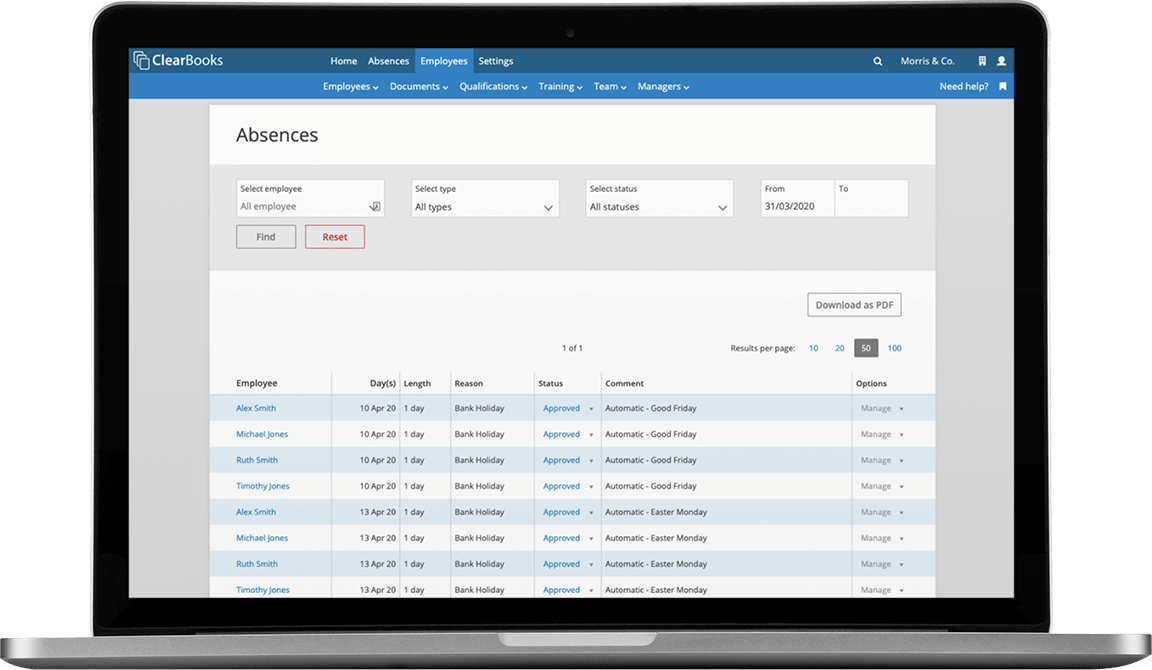

Keep track of employee leave without hassle. Your team members can request leave (e.g. holiday or illness) in seconds, and you'll always know how many days they have remaining.

It's a simple way to eliminate manual spreadsheets and calendars. All you need to do is provide your employees with access to the employee portal.

If you're after more advanced Payroll features - we have heaps to offer!

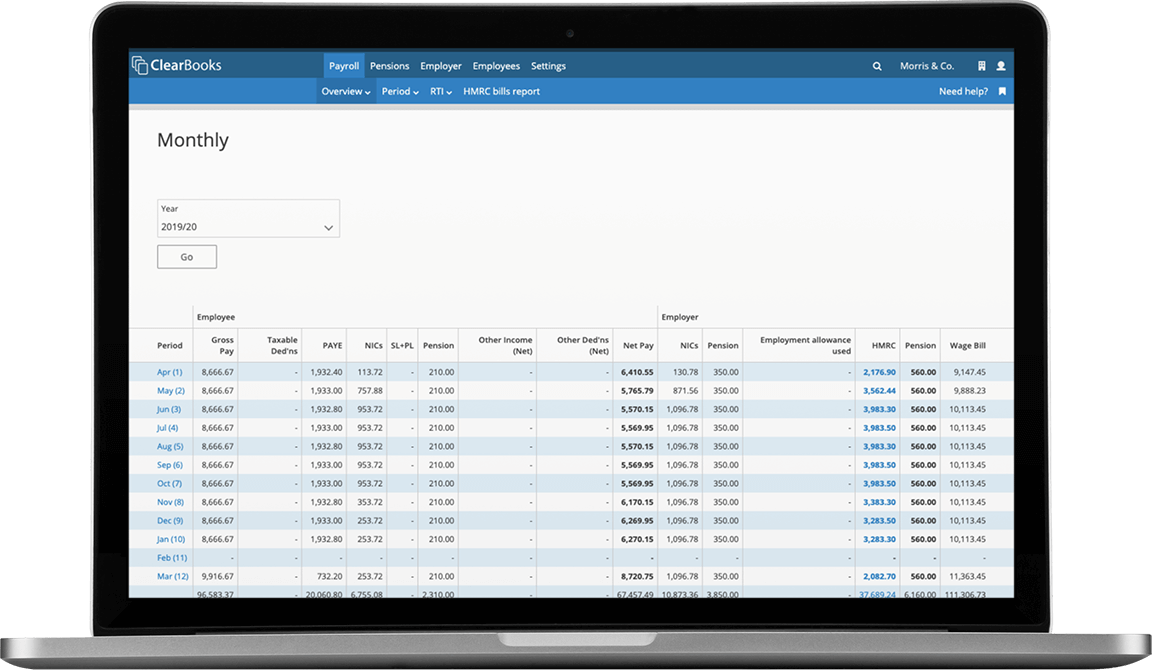

We'll help you get overtime, bonuses, deductions, Statutory Maternity Pay and salary sacrifice deductions sorted. Simply enter them into Clear Books and we'll update pay calculations and payslips.

Assess your employees for auto- enrolment, adding a pension as a percentage of the gross salary, or as a fixed amount. The rest is done for you.

Want to get payroll out of the way early? Create payslips in advance and schedule employee emails to send automatically on pay day.

If your business is eligible to reduce your employer's National Insurance contributions using the £10,500 employment allowance from April 2025, you can report to HMRC with Clear Books.

Directors' National Insurance contributions are calculated using the Annual Cumulative Method. Clear Books provides easy support for directors' payroll.

When you raise invoices and bills in Clear Books, you can pull CIS deduction values directly into Clear Books payroll, making CIS a breeze.

Clear Books, accredited by The Institute of Certified Bookkeepers and registered with the Financial Conduct Authority (reg. no. 843585), delivers valued, comprehensive online accounting software for small businesses in the UK.