Making Tax Digital (MTD) is HMRC's plan to modernise the tax system. It requires businesses and individuals to keep digital records and submit updates to HMRC through compatible software.

It applies to:

The aim? Reduce errors, increase transparency — and move away from paper and spreadsheets for good.

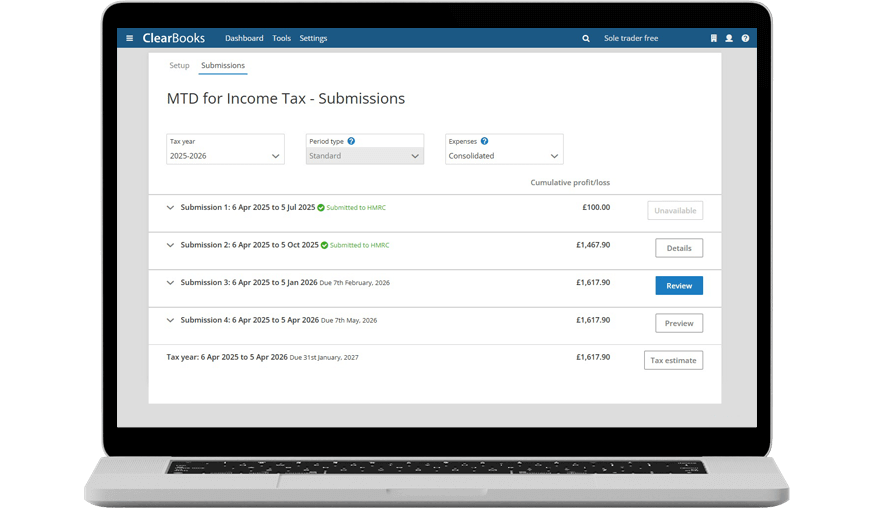

If you're self-employed or a landlord, MTD for Income Tax starts soon — and you'll need to be ready.

MTD for Income Tax (MTD ITSA) is the biggest change to Self Assessment in a generation.

From April 2026, sole traders and landlords will need to:

If you earn over £50,000 per year, the deadline is just months away. If you're under that, your turn is coming soon.

Don't wait. Clear Books helps you track your self-employed income and rental income in one place — so when MTD ITSA kicks in, you're already compliant.

We offer a free plan for sole traders and landlords with basic needs.

Already VAT registered? You should already be following MTD rules.

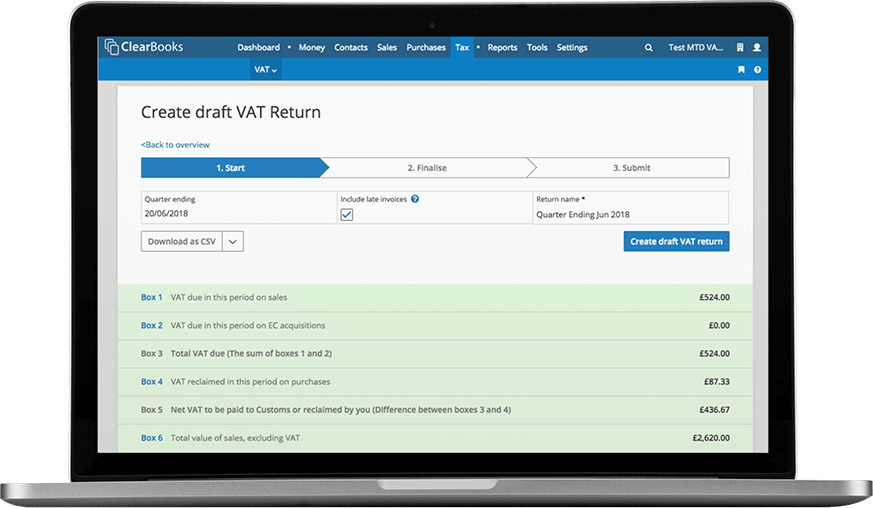

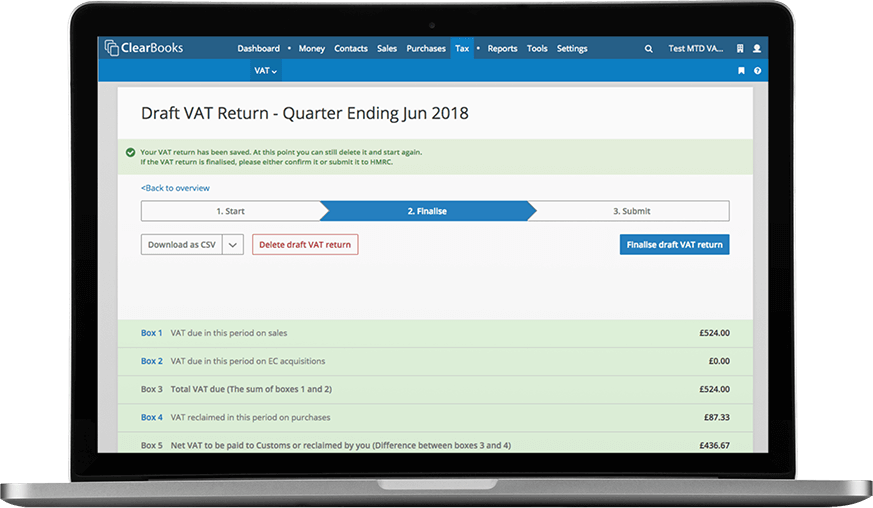

All VAT-registered businesses — regardless of turnover — must:

Clear Books makes VAT compliance effortless:

Clear Books, accredited by The Institute of Certified Bookkeepers and registered with the Financial Conduct Authority (reg. no. 843585), delivers valued, comprehensive online accounting software for small businesses in the UK.