Making Tax Digital (MTD) is the government's initiative to digitise record keeping and increase reporting for businesses in the UK.

The aim of MTD is to make it easier for individuals and businesses to get their tax right and keep on top of their affairs.

MTD includes VAT-registered businesses, and Income Tax Self Assessment for the self-employed.

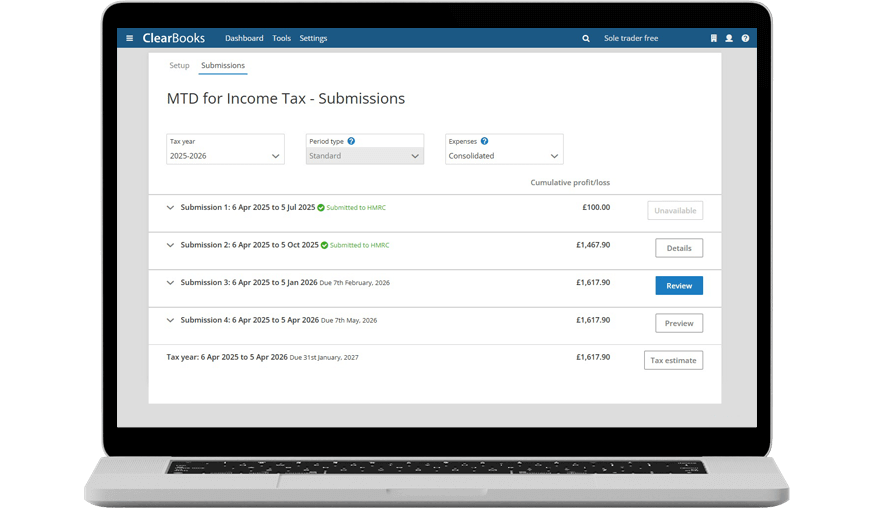

Making Tax Digital for Income Tax Self Assessment (MTD ITSA) is the next stage of the MTD rollout.

From April 2026, individuals and landlords will need to follow the rules and submit returns digitally to HMRC. If your revenue is less than £50,000 per year you have another year to prepare, having until 2027 to be compliant. If your revenue is less than £30,000 per year, you will have longer to prepare.

Use Clear Books for your sole trader business or landlord income, and easily generate Self Assessment income tax returns for your self employment and landlord income. Then, when MTD ITSA becomes mandatory, being compliant will be that much easier.

Be MTD ready with Clear Books.

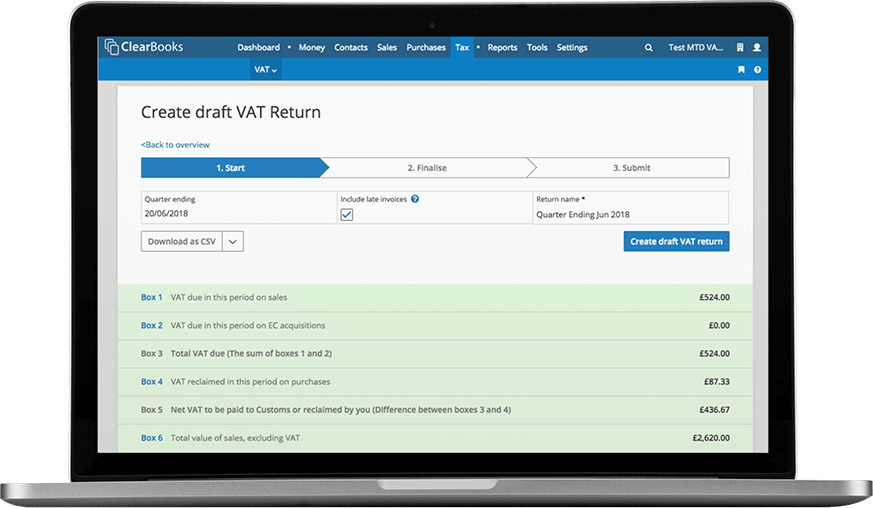

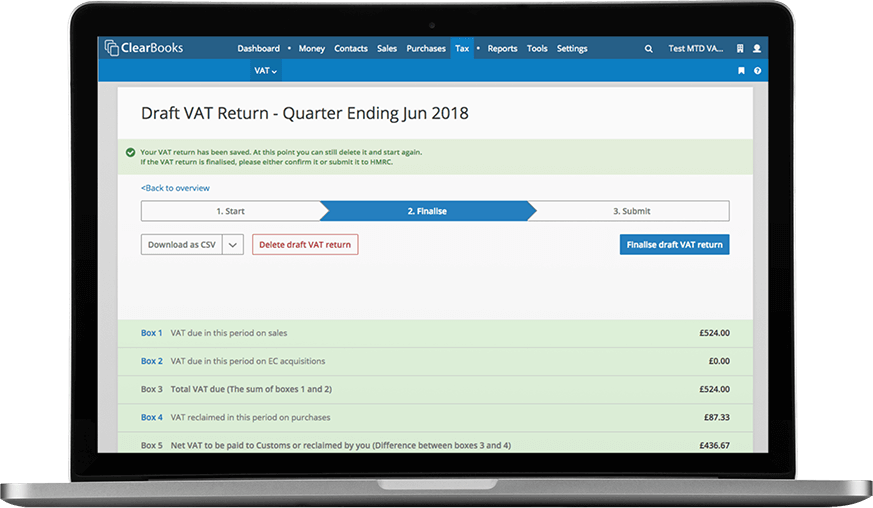

All VAT-registered businesses, regardless of turnover, must use HMRC-recognised software to prepare and submit submit MTD VAT tax returns directly to HMRC.

If you're submitting MTD VAT returns for the first time, don't panic! Clear Books is HMRC recognised software that ensures you comply with the rules. Create, review and submit VAT returns in just 3 simple steps with our HMRC recognised software.

Clear Books is award-winning online accounting software designed for UK small businesses.

Clear Books, accredited by The Institute of Certified Bookkeepers and registered with the Financial Conduct Authority (reg. no. 843585), delivers valued, comprehensive online accounting software for small businesses in the UK.