Run your accounting or bookkeeping practice on Clear Books - the UK's most loved accounting software.

or call 0800 862 0202

HMRC recognised

Compliance built-in

Exceptional support

Drowning in low-margin grunt work? Shred manual data entry with Clear Books.

MTD is here. Clear Books has compliance built-in.

Feeling unloved by other software providers? Clear Books is UK-based and support is second-to-none.

Hundreds of bookkeepers and accountants, and their clients, use Clear Books every day.

Setting up your practice, or joined a franchise? Clear Books is great for new-to-practice firms, whether you’re starting up in your evenings and weekends, or you’ve taken the plunge and working full-time launching your practice.

Avoid the regulatory minefield

Embrace the side-hustle hours (if you need to)

Choosing a tech stack on a shoestring

Business-continuity made easy

Launch your accounting or bookkeeping practice with Clear Books today.

Clear Books is great for sole practitioners, with an all-in-one platform, easy to use tools for you and your clients, and packed with free functionality. Get started today.

Buy back time (that you don’t have)

Be compliant

Share with your clients - or don’t

Run your solo firm without a team or headaches, with Clear Books.

Grow and run your firm, with hundreds of clients on Clear Books.

Facing the talent & capacity crunch?

Impacted by legacy tech sprawl?

Not getting value from your current provider?

Speak to us about migrating your established firm to Clear Books.

| Old way | Clear Books way |

|---|---|

| Manual bank recs | Auto‑reconciliation in seconds |

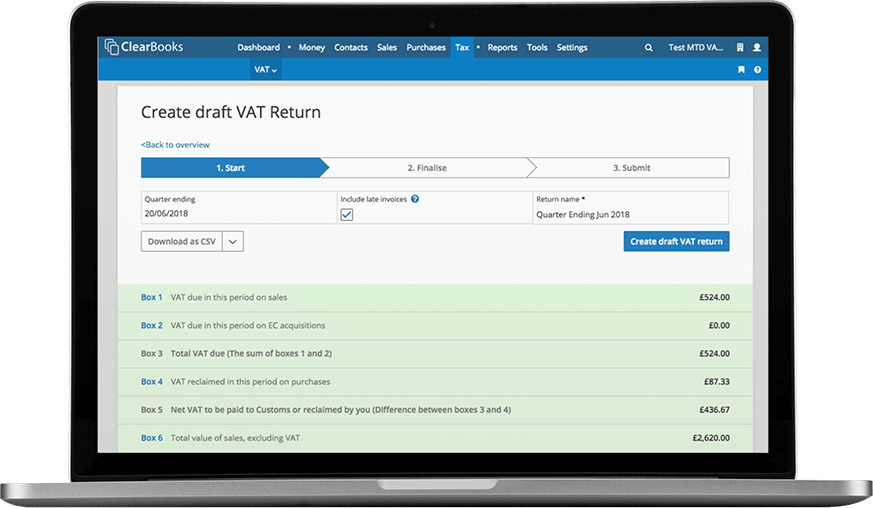

| Hours spent on MTD returns | MTD filing in one click, with HMRC-registered software |

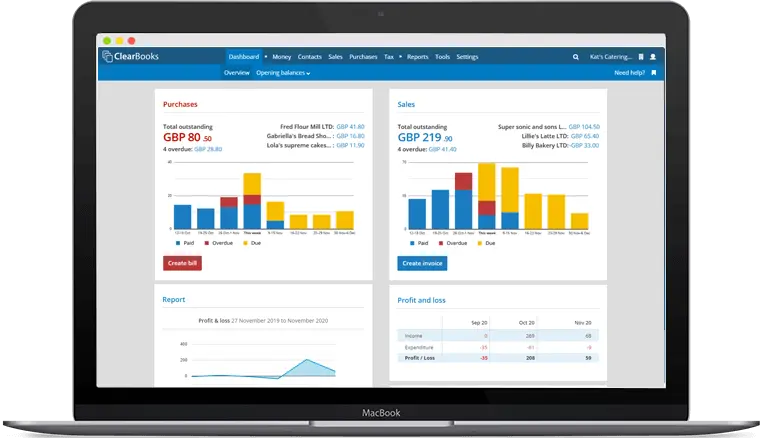

| Static management reports | Live dashboards clients actually read |

| Siloed data | Single ledger across your team and your client |

| Billable time lost to clunky systems | Automations that run themselves |

| Unresponsive software support | Your phone call answered by a real person |

This is what accountants and bookkeepers say they love most about Clear Books:

Quarterly updates and year-end tax filing for MTD income tax. VAT returns in one click. HMRC recognised.

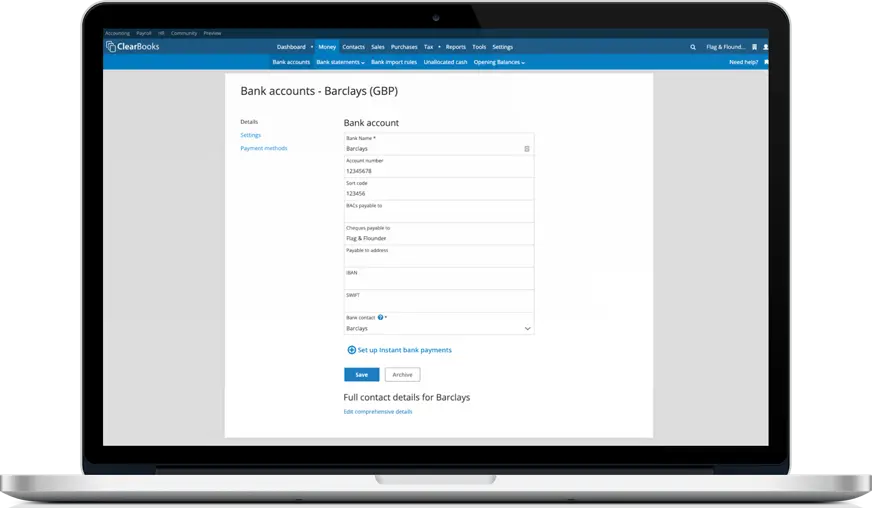

Direct, secure open banking feeds from over 70 UK banks, including all major UK banks.

Firm‑wide view of every client ledger, deadline tracker, and client alerts.

Clients snap receipts; our machine‑learning engine codes the transactions for your review.

Connect with other software, or build you own with our API.

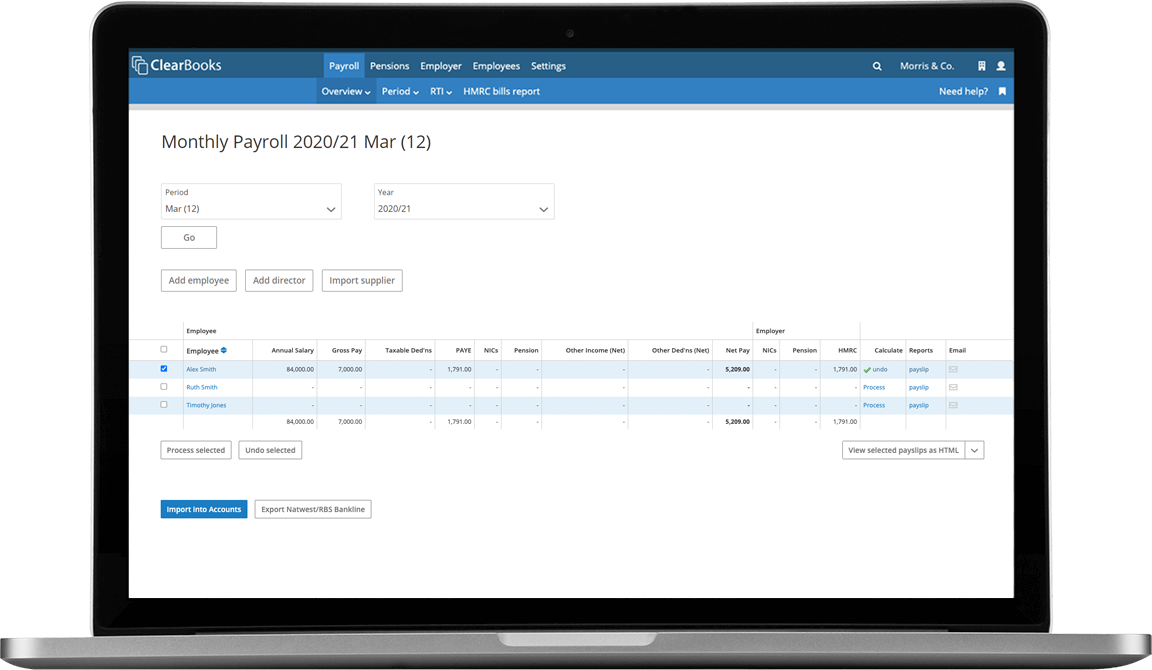

MTD for Income Tax, MTD for VAT, payroll submissions, Construction Industry Scheme submissions. All in one platform.

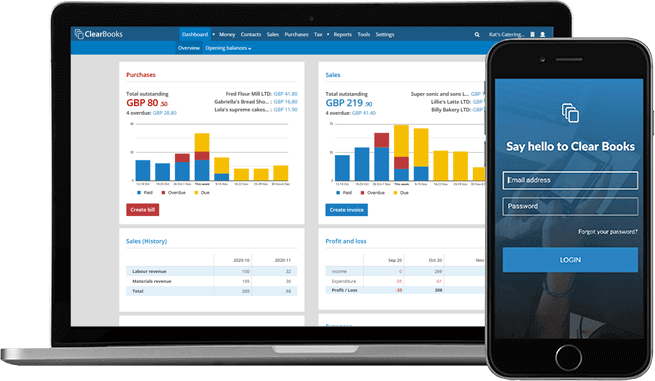

Choose the right software that suits the needs of your practice and your clients.

Full double-entry, with invoicing, bills, bank feeds, reporting, permission controls - you name it. Everything you expect from market-leading accounting software.

Receipt and bill scanning, intelligent AI-powered OCR extracts key details with exceptional accuracy.

Register as an accountant/bookkeeper for free, and benefit today. There are no signup fees, or ongoing costs.

Your FREE registration includes:

Run your own accounts and payroll on Clear Books if you want to, for free.

Track your clients, their deadlines, notes and alerts. Works for clients on Clear Books and clients on other software.

For your self employed and/or landlord clients with basic needs. Learn more about our free plan.

Run your payroll bureau on Clear Books at no cost.

All accounting plans come with MTD for Income Tax included, at no additional cost. Learn more about MTD.

Clear Books comes with stacks of benefits for accountants and bookkeepers:

Available to purchase:

Benefit from discounts up to 50% off accounting software for your clients, including our plans Small, Medium, and Large. You can pay for the subscriptions, or let your clients pay.

Your client accounts can add on Instant Bank Payments, Auto Bills, and Payroll.

Power-up your practice with powerful and cost effective Practice Edition accounting software.

Our online accounting software is award-winning and industry-accredited, so you can be confident that Clear Books will deliver for you. Don't just take our word for it - read what our accountant partners are saying about Clear Books:

Yes — Clear Books is fully HMRC-recognised for both VAT and Income Tax. All our plans include MTD for Income Tax features at no extra cost, including quarterly updates and year-end filing.

Your clients’ data is securely stored in UK/EU data centres with end-to-end encryption, automated backups, and enterprise-grade disaster recovery — built to meet strict compliance and privacy standards.

Every Clear Books account includes free training for you, your team — and even your clients. Our UK-based support team is top-rated and available whenever you need help.

Yes. You can access and manage multiple clients from a single login, with tools built for accountants — including client dashboards, permissions, and direct filing to HMRC.

Yes. Your MTD clients with basic needs can sign up to Clear Books with a free plan that includes all the core MTD for Income Tax features they need — no hidden charges. They can upgrade to a higher plan if you wish.

Absolutely. You and your clients can work together in real time — enter transactions, check submissions, and upload files — all without chasing spreadsheets or emails.

Clear Books is ideal for sole traders, landlords, and VAT-registered businesses — especially those transitioning to MTD. It’s easy to use, even for non-accountants. Clear Books also works great for limited companies, partnerships, and charities, but these will require a paid plan.

Unlike temporary solutions, Clear Books offers full digital links, built-in error checks, and direct HMRC submissions — all in one platform. No copy-paste, no workarounds.

They can still use Clear Books to stay organised and ready. And once they cross the threshold, they’re already set up for compliance — no switching tools needed.

Clear Books, accredited by The Institute of Certified Bookkeepers and registered with the Financial Conduct Authority (reg. no. 843585), delivers valued, comprehensive online accounting software for small businesses in the UK.