Simplify tax season and get ready for MTD for Income Tax with Clear Books — HMRC-recognised software for sole traders and landlords.

We offer a free plan for sole traders and landlords with basic needs.

From April 2026, sole traders and landlords must start to follow new MTD for Income Tax rules:

Clear Books helps you stay compliant without the stress.

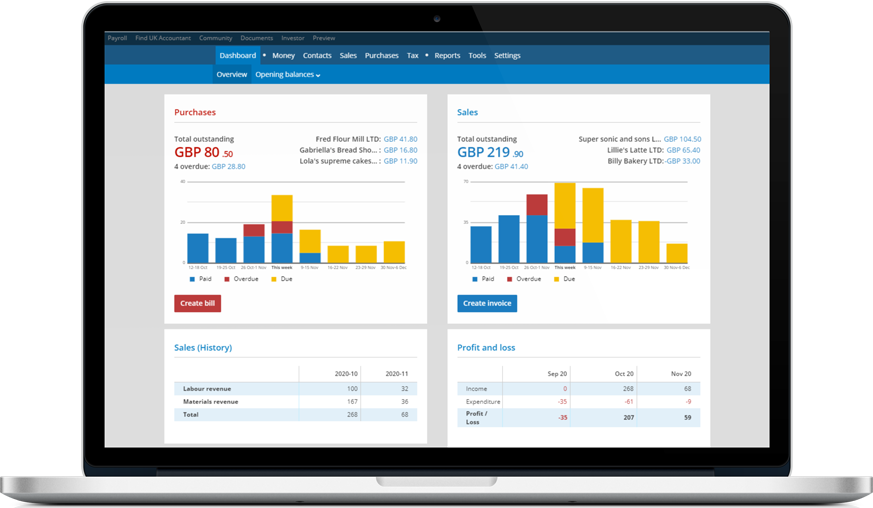

Our easy-to-use software keeps you on top of income, expenses, and tax — so you can focus on your business, not paperwork.

Never lose a receipt or forget to record income. With our award-winning software and mobile app:

We support thousands of businesses and landlords with MTD each year.

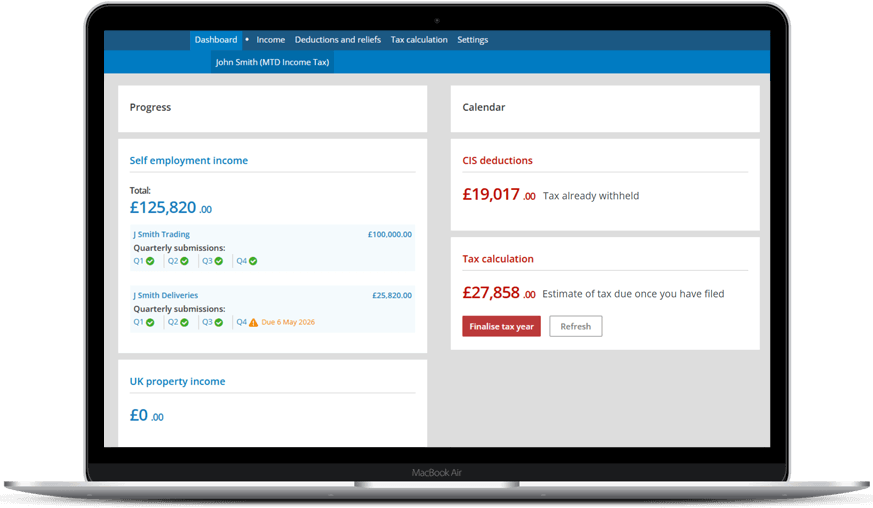

Clear Books makes MTD for Income Tax quarterly updates simple:

Stay compliant and avoid last-minute stress — every 3 months.

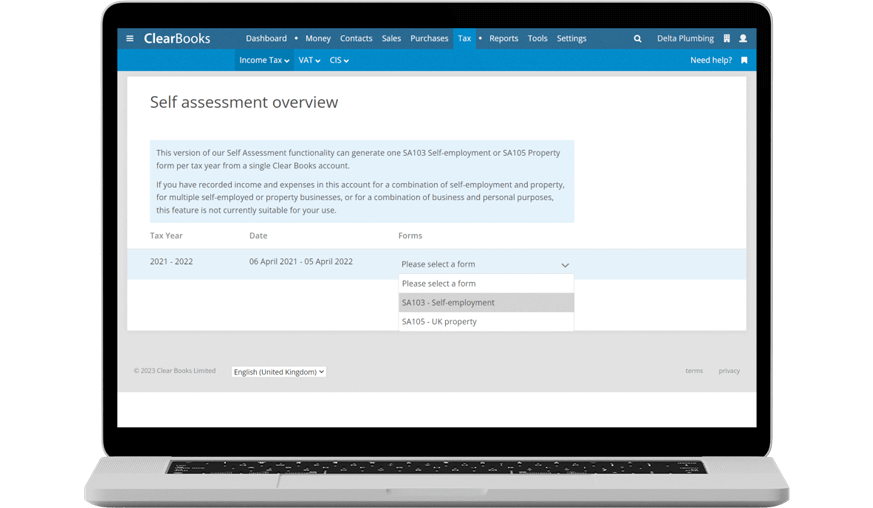

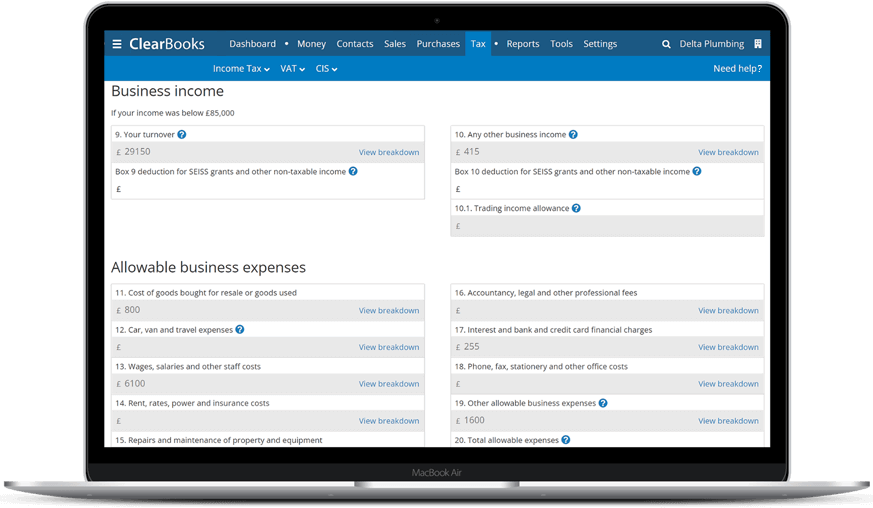

When it's time to finalise your Self Assessment:

Clear Books keeps everything in one place — so year-end is just a final check and submit.

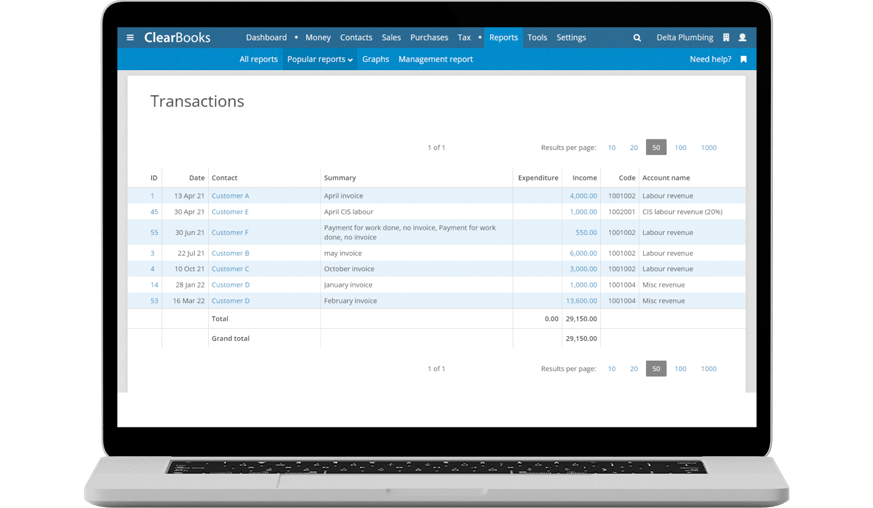

Whether you raise invoices or just record bank payments, Clear Books fits your workflow — and automatically includes your sales in your MTD quarterly updates and your end-of-year return.

You don't need an accountant, as you can submit your quarterly updates from within Clear Books yourself. If you're not confident with your end-of-year tax filing, you may want help from an accountant for that.

In a word, no. There are no penalties from HMRC related to the accuracy of the quarterly updates, but there are deadlines by which the updates must be submitted. Using Clear Books will make it easier to submit quarterly updates on time, and help improve the accuracy of them, too.

No. MTD quarterly updates don't trigger a tax liability - but they do give you better visibility into what your tax might be at the end of the year.

Try Clear Books free for 30 days.

We offer a free plan for sole traders and landlords with basic needs.

Clear Books, accredited by The Institute of Certified Bookkeepers and registered with the Financial Conduct Authority (reg. no. 843585), delivers valued, comprehensive online accounting software for small businesses in the UK.