If you’re wondering what GoCardless is and what an integration with Clear Books mean, here’s a quick snapshot:

GoCardless is a payment tool integrated with Clear Books allowing you to request and receive Direct Debit payments from your customers.

We are now happy to announce that the revamped GoCardless integration has been released. The new changes looks something like this:

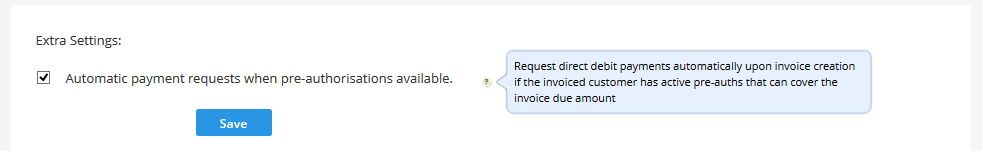

GoCardless settings – Option to automatically take payments upon invoice creation

This was a bit confusing before as the payment requests were not fully automated and still needed your input to be processed. Processing is now 100% automatic if the customer you are invoicing has enough funds available in pre-authorisations to cover the amount invoiced.

More details can be found in the following guide: GoCardless automatic payment request.

Invoice view – Generate payment requests

Now, any invoice payment can be requested straight away from the invoice view using your GoCardless integration as explained in this guide. Find out more about our invoice generator here

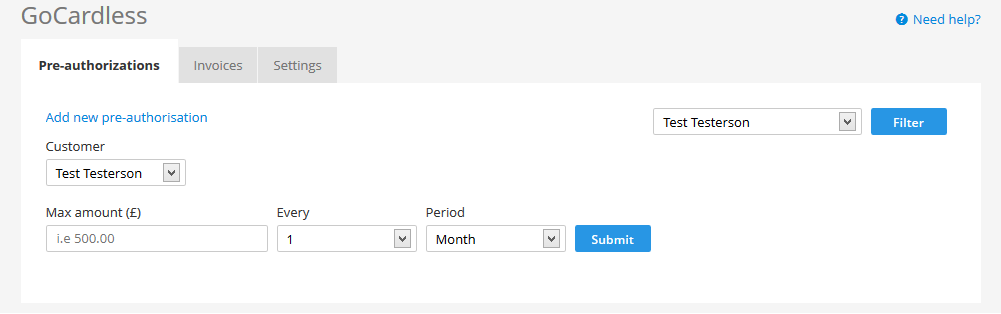

Pre-authorisations

Requesting pre-authorisations for your customers has also been simplified so now you can email your customers with a pre-authorisation request. For more details check the following guide: GoCardless request pre-authorised payments.

GoCardless invoices

Now there is an option to request payments from the GoCardless specific menu, where you can request one-off payments or use the funds available in pre-authorisations. In this view you’ll find your GoCardless invoices filtered by customer and will be able to easily see the status of your Direct Debit payment requests. More details in this guide.

We hope you enjoy these updates! Please leave your feedback in the comment box below.