Today we are announcing two new products to help small businesses meet the requirements of Making Tax Digital:

-

- Clear Books Practice Edition for accountants; and

- Clear Books Micro for small businesses

Tax today

Making Tax Digital (MTD) is looming on the horizon, but both accounting practices and small businesses aren’t yet ready for the digitisation of tax. With so many small businesses keeping manual records or desktop spreadsheets to record their accounting and tax information, a significant number will struggle to digitise their tax submissions – the stress of which will be projected onto accountants, in some cases at the last minute before filing deadlines.

The uncertainty around MTD will bring clients to their accountant asking “what do I do?” or worse yet, feeling paralysed and doing nothing. Small businesses are already grappling with accounting software, managing their business, and now they have MTD to keep them up at night.

Many small businesses using spreadsheets or manual records don’t need fully-featured accounting software, and can’t afford to pay fees for a feature-rich product when they probably won’t use most of those features.

Accounting practices might see the opportunity to expand their customer base or to restructure their services to offer more value-add services – or might see MTD as a distraction from their core business. Regardless, doing nothing is not an option.

Two new products to make MTD a breeze

Since 2008 Clear Books has led the way in UK cloud accounting – and we are again leading the way with MTD. We understand that MTD represents a challenge to small business, and both a challenge and an opportunity to accountants. Our purpose to provide clear & simple accounting software for small businesses and the accountants who support them manifests in two new products for Making Tax Digital – presenting the next incarnation of how we are delivering on our vision.

Clear Books Micro

Clear Books Micro is a simple and free online accounting spreadsheet for small businesses. With Clear Books Micro, enter sales invoices, expenditure, and bank receipts into a familiar and simple spreadsheet view, and maintain digital record keeping stored securely in the cloud.

Clear Books Micro helps accountants – small businesses can invite their accountant to collaborate, meaning it’s easier for accountants which leads to fewer headaches and less chance of extra fees – and puts accountants in a great place to cover the MTD requirements for their clients.

Clear Books Micro works for small businesses with or without VAT, and offers an upgrade path to the successful Clear Books Small or Large plans for businesses that find they outgrow a spreadsheet.

Find out more about Clear Books Micro.

Clear Books Practice Edition

Our award-winning cloud accounting software offers more than ever for accountants. Clear Books Practice Edition allows accounting practices to streamline MTD filing and save time by managing spreadsheet clients in the cloud under a single interface.

Accountants can use Clear Books Practice Edition to:

-

- Make managing clients who use spreadsheets a breeze

-

- Future proof their practice for MTD

-

- Increase efficiencies, enabling better fee recovery

-

- Collaborate with clients who are using Clear Books Micro in the cloud, anywhere, anytime

- Easily prepare accounts and submit returns directly to HMRC from spreadsheet clients who are using Clear Books Micro

Accountants can subscribe to Clear Books Practice Edition at only £5 per client per month – that’s less than 18p per client per day!

Find out more about Clear Books Practice Edition and how it works with Clear Books Micro.

Clear Books Micro and Practice Edition work hand-in-hand

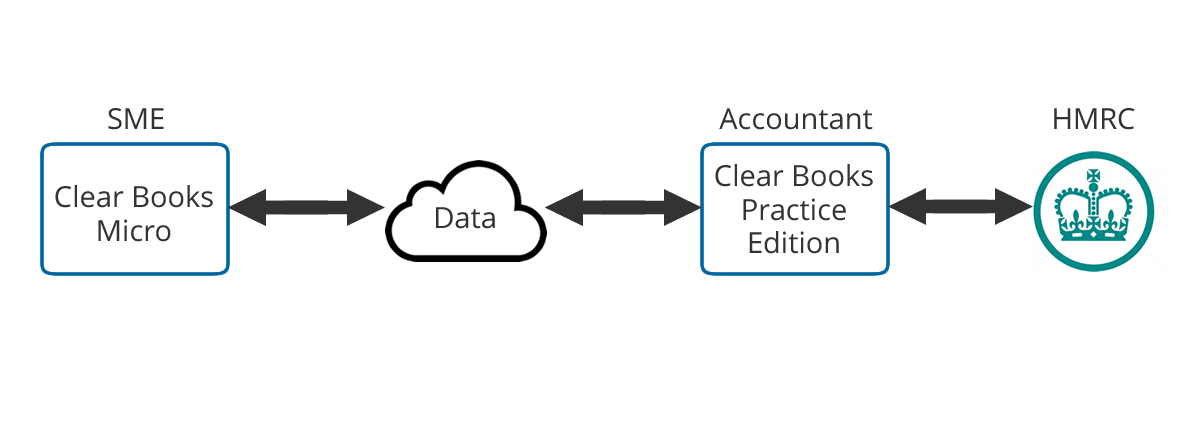

Small & Medium Enterprises (SMEs) can invite their accountant to collaborate on their Clear Books Micro data – which an authorised accountant can view through Clear Books Practice Edition.

Accountants can prepare accounts with the accounting information that small businesses have entered into Clear Books Micro. Accountants can digitally submit filings to HMRC through Clear Books Practice Edition.

Clear Books has MTD in hand

Clear Books is UK-based and focussed entirely on the UK market. With our dedicated London-based team, our focus is on empowering small businesses and accountants to get on with what they do best. Since 2008 we been delivering award-winning cloud accounting software, and we are again leading the way with MTD.

Small businesses and accountants can rest assured knowing that Clear Books Micro and Clear Books Practice Edition are the right options to alleviate the challenges and risks presented by MTD, whilst benefiting from digital accounting and tax compliance in the cloud.

With nearly a decade of experience delivering award-winning cloud accounting software in the UK, market-leading customer support, and a clear plan on how to handle MTD, Clear Books provides the perfect solution.

Stay up to date with MTD and Clear Books’ new products

Keep up to date on Making Tax Digital by visiting Clear Books.