Today we’re introducing a feature many of you have been asking for – the ability to pick up late invoices on a VAT return.

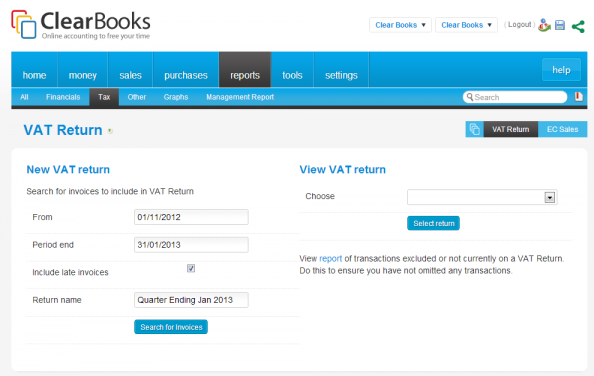

When you create a new VAT return, just tick the “Include late invoices” box and it will pick up any invoices in prior periods that were not included on a previous return. Super easy to use 🙂

Hi Simon, it’s always been possible to gather late invoices by changing the start date of the VAT return. We’ve always tried to make it clear that invoices are picked up between the start and end date input.

There is also a VAT exceptions report that highlights the invoices and bills that are not included on a VAT return.

But we appreciate the need to automate the picking up of really old invoices and now you can!

Hi Kirsty, that is the case for cash accounting. For cash accounting we check the date paid. For accruals accounting we check the date invoiced.

Hi Gordon, we did think about introducing a cut off, perhaps just to look at the prior quarter, but decided that the start date could be adjusted manually if people want to be specific.