Not all companies are entitled to Employment Allowance this year.

Check your eligibility

If you’re using our Payroll application for Employment Allowance this year, we advise that you check your eligibility before enabling it. Clear Books cannot check your eligibility for you.

What is Employment Allowance and who can claim it?

With the Employment Allowance, you have the chance to get up to £3,000 a year off your National Insurance bill if you’re an employer. The allowance will reduce your employer’s (secondary) Class 1 National Insurance each time you run your payroll (until either the £3,000 has gone or the tax year ends).

Employment Allowance is for most employers that pay their Class 1 National Insurance contributions on their employee’s and director’s earnings. This also includes businesses, charities and community amateur sports clubs. Please note that you can only claim Employment Allowance for one PAYE scheme.

Who can’t claim Employment Allowance?

However, there are a few circumstances when you can’t claim the Employment Allowance:

– If you’re the director and only paid employee in your company

– If you employ somebody for personal/domestic or household work (such as a nanny, cleaner or gardener) – that does not include care or support workers.

– If you’re a public body/business doing more than half of your work in the public sector (for example, local councils and NHS services) — that does not include charities.

– If you’re a service company with only deemed payments of employment income under ‘IR35 rules’

How do you claim your Employment Allowance through Clear Books?

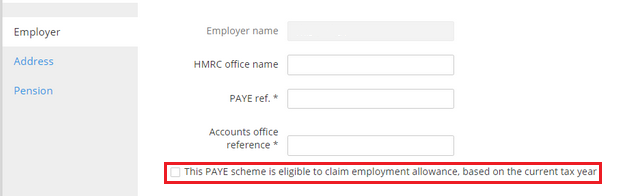

To claim your Employment Allowance through Clear Books, simply go to Employer > Details menu and check the box shown below.

Find out more about the Employment Allowance on the official HMRC website.