Do you know your own credit score?

As costs increase, inflation remains unsteady and economic uncertainty still feels top-of-mind, it’s never been more essential that businesses use their smartest tactics. When it comes to maintaining business control, obtaining the best terms from suppliers and lenders is one...

Funding in critical times

Businesses need finance for a variety of different reasons. Yet, what stays constant is that when businesses access the right funding, they can say ‘yes’ more to their next project, goal and growth plan. The economic environment remains challenging for...

Trade insurance – what is it and should you consider it?

Running a trade business can be extremely rewarding, but it also comes with its own set of challenges and risks. Trade insurance can help protect against unexpected loss, damage or injury, and the financial impact that this can have on...

Why every business should prepare for cyber risks

If you are a digital business – one with systems, networks or data – you will encounter cyber risks. When you think of cyber risks, you’ll probably think of big corporates or tech companies being hacked for their customers’ sensitive...

Making Tax Digital for Income Tax Self Assessment (MTD ITSA) FAQs

Making Tax Digital for Income Tax Self Assessment (MTD ITSA) is coming, and Clear Books is here to help you prepare for the changes. If your business is VAT registered, you will already be familiar with MTD, the government’s initiative...

Making Tax Digital for Income Tax Self Assessment – how it affects landlords

Making Tax Digital (MTD), the Government’s initiative to digitise tax and record keeping, is extending to Income Tax from April 2024. For many, Making Tax Digital for Income Tax Self Assessment (MTD ITSA) will be the first time that they...

Open Banking – what is it and how does it work?

As a small business owner, you know by now that cash is king! Getting a good grip on your cash flow is so important for small businesses owners and freelancers, because the survival of your business depends on it. With...

Employee vs Contractor – understanding what’s right for your business

Expanding your business is an exciting step for any entrepreneur. But there’s a lot to think about, and how you choose to expand your team will have a huge impact on your business. You know you need more people, but...

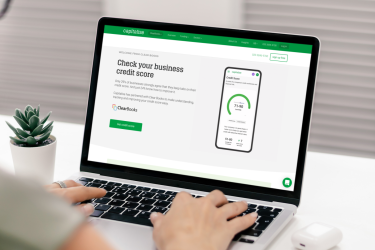

Clear Books users can track their business credit score with Capitalise for Business

We're pleased to announce that we have partnered with Capitalise to provide Capitalise for Business for Clear Books users, allowing them to track their business credit score and access better fit funding from over 100 lenders. Powered by Experian, Capitalise...

How to breathe new life into your marketing plan

Putting together a marketing plan is such an important step for a small business owner. But unlike a lot of other tasks that are completed once they’re ticked off, a marketing plan requires a little bit more TLC to ensure...

Selling your business? Here are 4 things to watch out for

You’ve decided to sell your business, done a bit of internet research, and now your mind’s reeling because it sounds both complicated and overwhelming. Navigating the potential pitfalls, including legal issues, financial accounting, taxes, feels like a full-time job in...

HM Queen Elizabeth II

Everyone at Clear Books is deeply saddened by the passing of HM Queen Elizabeth II. Our thoughts are with the Royal Family, our customers and partners, and everyone across the country affected by her passing. The longest reigning monarch in...

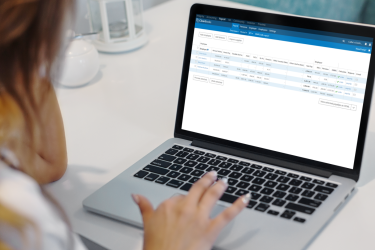

Easy Payroll with Clear Books

This week we’re celebrating National Payroll Week – a celebration of the impact that payroll has on the UK economy, through the collection of income tax and National Insurance. Making sure your staff are paid properly and on time is...

Building an inclusive workplace: how to make every voice matter

The conversation about why diverse and inclusive work environments are important is everywhere. It’s most definitely a good thing, and something that we at Clear Books highly value. Strong businesses are built around the idea that a company excels with...

Get paid faster with Instant Bank Payments

Instant Bank Payments is here! Our new feature to help Clear Books users get paid faster by enabling their customers to pay instantly and directly via bank transfer. How does Instant Bank Payments work? In order to get paid faster,...

Delegate without fear — what you need to know as a small business owner

The good news? your business is thriving! The bad news? You’re still doing it all. Even though you have staff, you’re still handling many of the daily operations yourself — emails and phone calls, bids and vendors, marketing, and scheduling. ...

Why your small business needs an exit strategy — even if you’re not planning your exit just yet

Does your business plan include an exit strategy? If your answer is “not yet” — or if this is the first you’ve heard of it — you’re not alone. What is an exit strategy? Put simply, an exit strategy is...

From small business owner to employer: How to nail time management when you make your first hire

Your business is growing in ways you’d never even imagined. You’re keeping all the balls in the air (so far), but you have this nagging feeling that it won’t be long before you drop one. Managing all the day-to-day operations...

How to sell without being ‘salesy’ — 3 tips for selling, without selling your soul

The knot in your stomach before you make that sales call. That awkward feeling when you’re pitching to a client because you already know they’re not interested. The dread of an unanswered email enquiry. It’s safe to say sales isn’t...

From employee to self-employed: here’s how to manage the transition

No matter your current position, whether you’re the CEO of a multinational corporation, an apprentice, or a new graduate with a part-time job, making the transition from employee to self-employed business owner comes with one heck of a learning curve....

How to create an offer your customers can’t refuse

Is it the right time to create an offer to drive sales? You hate to admit it, but you thought (or at least hoped) this would be easier. After all, you’ve ticked all of the business building boxes so far....

Starting a small business? Here are 5 things to avoid

We love sharing articles about what you should be doing as entrepreneurs and small business owners because we want to set you up for success. But what about the common pitfalls that many small businesses face? As a small business...

How to improve employee engagement (and why it’s so important that you do!)

We know that hiring your first employee (or employees) was a big deal. From figuring out how to define and advertise the position to finding the right person, buying uniforms and tech for them to use, and investing in their...

How to get the right insurance for your business

Why is it important to get the right insurance? So, you know you need insurance for your business, but how do you go about getting the right cover? Whether you’re buying insurance for the first time, or in the process...

Cutting business costs: how small businesses can make serious savings

At Clear Books, helping you make more money is baked into what we do, from the affordability of our software and our invoice automation tools to the extensive functionality that frees up the time you need to find and attract...

8 tips for getting invoices paid faster

When you think about the possibility of your business failing, there’s probably one thing that has you waking up in a cold sweat at 3am: The worry that you won’t be able to find enough clients to sustain your company’s...

Accountex: Top tips for making the most out of the event

After two years of postponed events, Accountex – Europe’s definitive event for accountancy and finance professionals – is just round the corner. The Clear Books team can’t wait to meet new and familiar faces at the event. You can find...

How to choose the right structure for your new business

When it comes to following your entrepreneurial dream, choosing a legal business structure might not be as exciting as creating a website, brainstorming business names, or designing your very first products. It can be tempting to just pick whichever structure...

How to work with a virtual assistant: 4 things you need to know

Have you considered working with a virtual assistant? If so, you’re not alone. Virtual assistants — or VAs — have become incredibly popular over the last decade and, as a busy business owner, you probably understand why. As your business...

A rock-solid business plan: the key to making your business dream a reality

It’s happened: you’ve finally hit on an amazing business idea — and you’re 99.9% certain that it has legs, that it will provide you with the income and life balance you’re searching for. You genuinely can’t wait to get started....