From talking to our customers, we know that one of the things you appreciate about Clear Books accounting software is the bank feeds feature. Setting up bank feeds with Clear Books simplifies data entry for business bills and makes it faster to reconcile your bank statements. By ensuring all available data is in Clear Books, bank feeds help create accurate financial reports and, of course, HMRC VAT returns.

However, there’s always room for improvement.

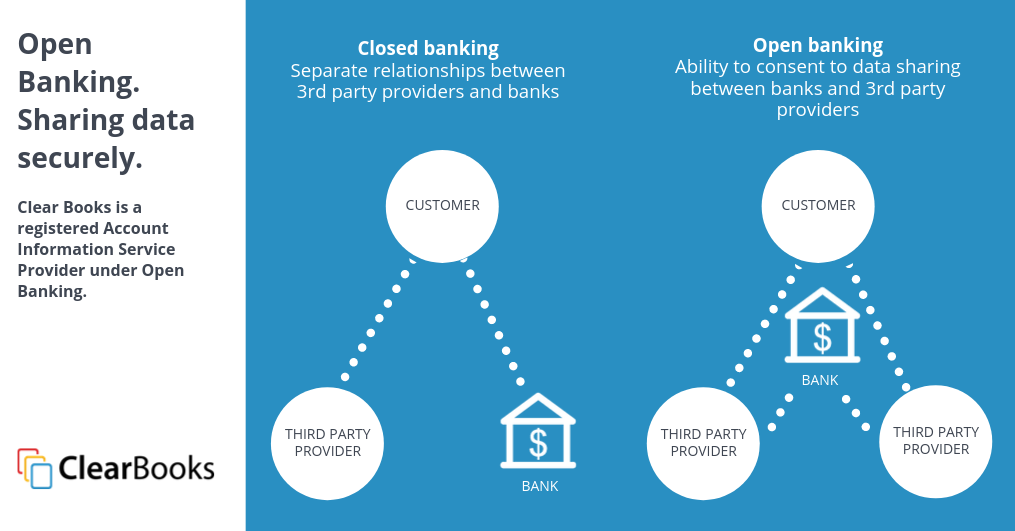

Until now, we’ve been at the mercy of a closed banking system. Banking data has been available in online banking and through paper statements, but those channels were not connected to other helpful financial tools (like your accounting software). Whilst vendors often used uploads or screen scraping technologies to access the data, the overall impact of the closed banking system was to keep many consumers locked into a single supplier, and reduce understanding of financial data.

The good news is that there is a way to make things better. There is a quicker, more flexible system that’ll give you and your clients more control over their banking data, including who they share it with, and for how long: Open Banking.

Open Banking explained

As the name suggests, Open Banking is the opposite of the closed system we’re used to. It comes as part of an EU directive, PSD2, that requires major banks to share their clients’ financial data with certain third parties should the client request it.

This means that consumers will have greater choice over the banking and software products they use, and that they (alongside their accountants) will be able to use third party products more efficiently. In the case of Clear Books software, we have registered with the FCA to offer open banking feeds that import your transactions directly from the major bank’s systems into Clear Books.

Clear Books Open Banking bank feeds

Clear Books has a partnership with Yodlee, who provide us with ‘fast link’ access to both Open Banking bank feeds (for the major banks) and screen scraping (for the minor banks). Clear Books users can choose their bank from the list of banks that Yodlee supports, and if they choose an Open Banking ready bank we fix them up with an Open Banking bank feed. If they choose a non-Open Banking ready bank we fix them up with screen scraping.

The Yodlee partnership has been in place for years but with the gradual introduction of more and more Open Banking feeds, we’re seeing greater efficiency, more robust security (more about that below), greater choice and control for users, as well as some exciting opportunities for future product features.

FCA Registration

When it comes to sharing data, particularly sensitive financial information, security is a key concern. Open Banking is only available to third parties that have been registered with the FCA as an Account Information Services Provider (AISP) or Payment Initiation Services Provider (PISP).

Any third party organisation that wants to apply for registration must submit to the highest level of scrutiny over their security processes to ensure that they can be trusted to handle financial information. Before taking advantage of Open Banking on behalf of yourself or a client, it’s vital that you check that any third party providing bank feeds is FCA registered.

We’re thrilled to announce that Clear Books has been successfully registered as an AISP and we can assure you that the registration process was rigorous!

Getting started with Open Banking bank feeds

To get started with Open Banking bank feeds you’ll be provided with a secure login screen into which your client can enter their online banking credentials and give permission for apps you trust — like Clear Books — to access certain types of transactional data. Once you’ve connected Clear Books to your, or your client’s bank, a daily feed of transactional information will be supplied from your bank to your accounting software. You can then use the accounting software to explain and reconcile transactions — only it’ll be a far more efficient process, making it easier and quicker for you and your clients to complete financial reports and HMRC VAT returns.

Changes you need to be aware of

We’re currently working behind the scenes with our partner Yodlee, finalising upgrade work so we can use their Open Banking service. We will, of course, be in touch with you via email and through in-product messages to keep you up-to-date with any upcoming changes and to provide guidance on any steps you might need to take to get started with Open Banking bank feeds.

Until then, do feel free to contact your Account Manager or our Support Team with any questions you might have. Our team is available between 9am and 5pm weekdays on 0800 862 0202.