MTD VAT is coming – is your business ready?

Soon all VAT-registered businesses will need to submit their VAT returns electronically to HMRC.

Whilst the thought of changing your processes to comply with MTD VAT may seem daunting, it can actually help save you precious time when it comes to generating and submitting your returns.

But where to start? We answer some of the most common MTD VAT questions from small businesses.

What is MTD VAT?

MTD is the government’s initiative to digitise record keeping and increase reporting for businesses in the UK.

MTD VAT is the first stage of the rollout and launched in April 2019. Since then, it has been mandatory for businesses with taxable turnover above the VAT threshold to submit their VAT returns to HMRC online.

The aim of MTD is to make it easier for individuals and businesses to get their tax right and keep on top of their affairs.

Who is affected by the next MTD VAT rollout?

All VAT-registered businesses will need to submit their VAT returns digitally, regardless of size, turnover or sector.

Businesses above the current VAT threshold of £85,000 will already be submitting their VAT returns to HMRC digitally.

When is the change coming?

The next stage of the MTD VAT rollout will come into effect from April 2022, so it is important that those affected act now to ensure they are ready for the change.

What do I need to do to prepare for MTD VAT?

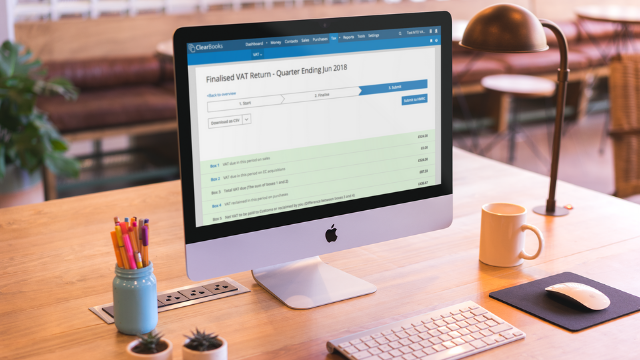

MTD VAT doesn’t need to be another piece of lengthy business admin. With HMRC-compatible online accounting software like Clear Books, MTD VAT is easy and stress free.

Clear Books is HMRC recognised, allowing you to report directly to HMRC with ease. With Clear Books, you can be confident that you are complying with the HMRC rules.

We are listed on HMRC’s Making Tax Digital software list and help thousands of small businesses like yours complete online VAT returns each month, quarter or year.

MTD can be confusing but we are here to help you through the process.

Is submitting a VAT return to HMRC a complicated process?

Creating VAT returns in Clear Books is easy and can be done in just three simple steps. Our software helps guide you through the process, outlining all the information you need. We also have lots of helpful resources and a friendly support team who are always on hand to answer any questions.

Start a free 30-day trial today to see just how easy it is to use Clear Books.

What are the benefits of MTD?

MTD may seem like it’s just more business admin for you to worry about, but there are a lot of benefits to digitising your processes.

MTD will make preparing and submitting returns faster, increase confidence that you’re getting tax right and reduce the potential for mistakes.

Another benefit is increased visibility – your tax affairs will be visible to you in your software real time, and you won’t need to wait until the end of the quarter to know how much tax you will have to pay upon filing a return.

Why does MTD only apply to VAT?

VAT is just the first stage of the MTD rollout.

Making Tax Digital Income Tax Self Assessment (MTD ITSA) is the next stage, and will apply to those with self-employment or rental property income from April 2024, and those in partnerships from April 2025.

COVID-19 has impacted the MTD rollout, pushing MTD ITSA back one year. Unsurprisingly, the pandemic has caused upheaval and uncertainty for UK businesses, and so the delay was introduced to give business owners an extra year to prepare for the upcoming changes.

MTD for Corporation Tax will also be introduced, but not before 2026.

Clear Books Online Accounting & Payroll Software

Clear Books is an award-winning online accounting software for small businesses. Thousands of business owners, contractors, freelancers and sole traders across the UK use our easy-to-use online accounting software to manage their business finances. All users benefit from the outstanding free telephone and email support. Clear Books was launched in London in 2008 and offers a free 30 day trial with free ongoing support and bank feeds. We’re rated as ‘Excellent’ on Trustpilot.

Get a free 30-day trial of Clear Books online accounting software.