Making Tax Digital (MTD) for VAT pilot testing

Clear Books has been working closely with HMRC to make sure our accounting software is ready for the implementation of Making Tax Digital (MTD) in April 2019. In order for HMRC to ensure the system is working as it should...

Use your blog to grow your accounting firm

Is your accounting firm onboard with blogging? We know it can seem like an unnecessary addition to an already lengthy task list, and you might even think no one is interested in what you have to say anyway (spoiler alert:...

5 things you can do to grow your accounting practice in the off-season

When working in accounting, it can seem like there are really only two parts to your year: tax season, and everything else. Of course, your work doesn't end when tax season does. Between extended tax filings, financial advising, and bookkeeping...

6 things you can do in the SME slow season

If this is your first year or so in the SME world, then brace yourself. You’re about to experience the seasonal ebbs and flows that make this type of work exciting if you know what’s going on, and terrifying if...

Government failing to understand our challenges, say small business owners

The majority of small business owners* in the UK do not think the government understands the challenges they are facing, or the opportunities open to them. In all, 82% of the owners we surveyed supported this point of view. Phil...

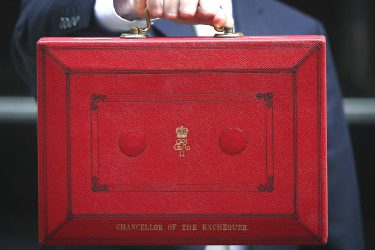

What has the Chancellor’s November Budget got in store for your business?

In this strange age of minority governments and Brexit negotiations, each new Budget has an added dose of importance – not least for the UK's small businesses planning for the future. Philip Hammond, the current Chancellor of the Exchequer, is...

What is amortisation?

Amortisation definition Amortisation is the process of reducing the value of an asset in order to show how its worth has reduced over time. It is therefore similar to depreciation, though it can be used to refer to the reduction...

What is accrual basis accounting?

Accruals basis definition The methodology behind accrual basis accounting is to make a record of revenues when they are earned - as opposed to recording them when the cash is actually received. Likewise, when using this method of accounting, any...

What is an accounting period?

Accounting period definition An accounting period is a set period of time for which financial statements are prepared, in order to show clearly what has happened during the period in question. Companies may choose to set their own internal accounting...

What are accounts?

Accounts definition Broadly speaking, there are four main types of financial statement you need to know about. These statements, or accounts, are prepared at the end of a set period of time to reflect the profits and losses recorded during...

What is accounts receivable (AR)?

Accounts receivable definition The term accounts receivable, or 'AR', relates to payment(s) that one company expects to receive from another. When a company purchases something from another company but doesn't immediately pay for it, the selling company will record this...

What is accounts payable (AP)?

Accounts payable definition The term accounts payable (AP) relates to goods or services that are received in advance of payment. This means the company that received the goods didn't pay for them in cash up front, and therefore acquired them...

Thanks for registering your interest!

Thank you for registering your interest in participating in the Making Tax Digital (MTD) pilot testing programme! While you're here, why not take a few minutes to check out some of our other blogs? Such as... 5 ways you should...

Clear Books – a brief history, what we do, and how we can help you

Clear Books is a company of smart, passionate people who are all focused on one thing: making it easier for you to manage your business’s finances. With over 10,000 customers, we’re on a mission to make accounting clear and simple...

Clear Books Payroll users – make sure you’re eligible for Employment Allowance

Not all companies are entitled to Employment Allowance this year. Check your eligibility If you’re using our Payroll application for Employment Allowance this year, we advise that you check your eligibility before enabling it. Clear Books cannot check your eligibility...

Is it time for you to hire an accountant?

You end up taking on so many hats when you become a small business owners — besides being the actual owner, you often have to be the customer service, HR, creative, operations manager, finance manager, and more. And while doing...

Calling all accountants, come to our next free open day and have lunch on us!

Clear Books Open Day Are you an accountant or bookkeeper looking to find out more about how Clear Books and cloud accounting can help you run your practice? Then we've got the perfect free event for you! The Clear Books...

What is depreciation and how do you calculate it in the UK?

What is depreciation? Depreciation is a term used in accounting to describe the cost of using an asset over a period of time (when it’s useful to your business). How do you calculate depreciation in the UK? There are two...

Improvements to ‘date picker’ calendar within Clear Books

What is it and what does it do? The ‘date picker’ is the small calendar that appears in various places within your Clear Books account, allowing you to select a date. This helps users work out the days of the...

Benefits of using cloud accounting software for business

More and more business owners are turning to cloud accounting software to manage their business’s finances. If you haven’t yet tried it yet, here are 10 ways online accounting software can help your business. 1. Save time with automation Don’t...

How to divide your day for maximum effectiveness

It’s always interesting to see how things become “normal” — for instance, since the Industrial Revolution, everybody’s pretty much just accepted that an 8 hour day (with one break in the middle) is how we should work. But actually, behaviour...

RTI payroll submission 2016

RTI payroll submission 2016 At the end of the tax year, HMRC need to know that the RTI (Real Time Information) payroll being submitted is the last submission of the year. This means that a number of declarations need to...

SEO for beginners: How to improve your SEO

SEO for beginners: How to improve your SEO SEO is one of those things that people talk about all the time in connection to websites, but it so often seems to be such a technical topic that many people ignore...

Helpful Clear Books Tips #5: Bulk payroll processing / un-processing feature

As cloud software providers, we always aim to make your experience with our accounting and payroll applications as simple as possible. That’s the reason we have made several useful time-saving features for you to use, so you can focus on...

5 benefits of having a website for your business

5 benefits of having a website for your business It might seem an obvious part of starting a business but a surprising number of entrepreneurs don’t consider setting up a website when they’re starting out. Reasons for this could include...

What is a dividend? How they’re paid, taxed and how to create them

In the previous blog for our 'Commonly asked accounting questions' series, we looked at what a creditor and debtor was. This time we’re focusing on what a dividend is, how you pay them and how you can create them within...

How to improve presentation skills

How to improve presentation skills An important part of most jobs, and particularly if you’re running your own business, is standing up and presenting in front of large groups of people. Whether it’s for a pitch, a conference, or even...

SEO podcast with Nic Cohen (founder of U-First)

SEO podcast For the latest podcast in our series, we spoke to Nic Cohen from U-First (an online and digital strategy consultancy). Nic spoke to us about what SEO is, why your business should consider incorporating SEO into your marketing...

Tax return deadline | Key tax dates 2016

Tax return deadline 2016 Self Assessment is the method that HMRC uses to collect your Income Tax. This tax is usually deducted straight away from your wages, pensions and savings. If you’re a person or business with another source of...

Digital tax accounts initiative

What is the digital tax accounts initiative? Living in the digital age, the process of buying goods or services is dramatically different to even 20 years ago. Before computers, smartphones and the internet, buying a product or service would have...